Accounting for the manufacture and installation of metal structures. Accounting of production operations

Main aspects of organizing and maintaining accounting records of finished products and their sales at LLC “SVS-Metallokonstruktsiya”

According to the Order on the accounting policy of LLC SVS-Metallokonstruktsiya, accounting is maintained by the accounting service, taking into account all regulations and legislative acts of the Russian Federation, using computer equipment and the accounting program 1C: Enterprise.

Finished products are part of an organization’s inventory, intended for sale, which is the end result of the production process, completed by processing, the technical and quality characteristics of which comply with the terms of the contract or the requirements of other documents in cases established by the legislation of the Russian Federation.

Due to the fact that a very large number of forms are used, in the accounting service of SVS-Metallokonstruktsiya LLC, three accountants deal with this directly, without being distracted by other areas. They fill out forms of primary documentation for the receipt and consumption of products; on the movement of products; for shipping products outside the Company; for selling products. Fill out registers and statements of product movement, issue vouchers for the export of products.

At SVS-Metallokonstruktsiya LLC, finished products are valued at actual cost.

SVS-Metallokonstruktsiya LLC has adopted a simple cost accounting method: they are written off directly to the corresponding facility. In this case, costs are grouped by type of production: main, auxiliary, service.

The costs of main production are differentiated according to their economic content into the costs of consumed fixed and working capital and labor costs; according to its technological features - for basic costs, that is, those that arose directly in connection with the production process: labor costs, costs for the purchase of materials and raw materials, operation of fixed assets, and overhead, that is, management.

General production expenses of SVS-Metallokonstruktsiya LLC are collected on account 25 “General production expenses. The debit records expenses, and the credit records their distribution. For example:

D 25 K 70 - wages accrued to employees engaged in production maintenance;

D 25 K 10 - material used for production, etc., is written off.

At the end of the year, general production costs are distributed and included in the cost of specific types of products indirectly, that is, by distribution in proportion to the selected base. General production costs are distributed in proportion to the main costs.

According to the accounting policy of the enterprise, the sequence of closing cost accounts is as follows: 23, 25, 26.

At SVS-Metallokonstruktsiya LLC, sales of manufactured products are carried out directly. The direct method involves delivering goods from the manufacturer directly to the consumer. Among the largest corporate clients LLC "SVS-Metallokonstruktsiya": holding "SVS"; JSC Russian Railways; CJSC MF "Stalkonstruktsiya"; CJSC "Stalkonstruktsiya-V"; JSC VU "Stalkonstruktsiya"; LLC "Steel Structures-1"; LLC "Sigma-M"; JSC "Stalmontazh"; MegaMechStroy LLC; LLC "Construction Company Temp 21 Century"; SK Promstroy Service LLC, Troy Rus LLC and others.

Settlements for such operations are made to account 62 “Settlements with buyers and customers”.

According to the accounting policy of the enterprise, shipment of manufactured products is carried out only upon prepayment, after shipment an invoice is issued. The products themselves are written off to the sales account.

Analytical accounting for account 62 is carried out for each invoice submitted by the buyer, and when making payments by scheduled payments - for each buyer or customer in the 1C: Accounting system. At the end of the month, data on account 62 is automatically transferred to the order journal, and from it to the General Ledger. Revenue from the sale of products is reflected in account 90 “Sales”:

D 62 K 90 - revenue from sales of products (works, services) is reflected.

Accounting for sales expenses at SVS-Metallokonstruktsiya LLC is carried out as standard. For analytical accounting, account 44 “Sales expenses” is used.

At the end of the year, LLC SVS-Metallokonstruktsiya determines the financial result of its activities. Indicators characterizing the economic efficiency of production activities are gross income, net income, profit. The financial accounting system, as a final stage, includes the derivation of financial results of activities in the form of profits and losses. For this purpose, account 99 “Profits and losses” is used, where losses are reflected in debit, and profits are reflected in credit. Comparison of debit and credit turnover for reporting period shows the final financial result of the reporting period - profit (loss).

In the organization's accounting data business transactions are reflected as follows.

OJSC "Metal Structures Plant" is one of the largest enterprises in the construction industry of the Russian Federation. The main activity of the enterprise is the production of multi-purpose buildings based on standard and individual projects.

The main activities of OJSC ZMK are:

Manufacturing of buildings and metal structures;

Design and development of buildings, preparation of technical documentation for packaging and transportation of metal structures;

Equipping buildings in cooperation with other enterprises;

Installation and supervision of buildings made of metal structures.

In addition, the company produces wall and profiled flooring and wall panels with mineral wool insulation for any climatic region.

OJSC ZMK cooperates with leading design institutes and design firms, which allows us to reduce the material consumption of structures and the cost of supplied buildings.

OJSC ZMK has licenses to carry out design work for buildings and structures of level II responsibility, to carry out production and quality control activities, to carry out construction and installation work for buildings and structures of level II responsibility.

The design solutions used by ZMK OJSC are Orsk modules, buildings based on variable-section frames, arched buildings and components for them. In addition, a set of technical documentation for buildings of type “xxx” is an object of intellectual property of ZMK OJSC, confirmed by patents and copyright certificates of the Russian Federation.

Based on the basic schemes of these buildings, various options for industrial and general purpose buildings have been developed and are being improved: industrial workshops, warehouses, shopping malls, granaries, grain storage facilities, mills, garages, sports arenas and halls, aircraft hangars and other engineering structures.

Installation supervision specialists from ZMK OJSC provide consulting assistance and monitor the construction of facilities.

The main production workshops of Metal Structures Plant OJSC are the enclosing structures workshop and the frame structures workshop. In addition to these shops, the production process of the enterprise includes a mechanical and tool shop, a motor transport shop, a repair and construction shop and an electrical repair shop.

OJSC Metal Structures Plant operates a centralized linear accounting department. That is, the organization’s accounting apparatus is concentrated in the main accounting department. It maintains all synthetic and analytical accounting on the basis of primary and consolidated documents coming from the organization’s divisions. In divisions, only the initial registration of business transactions is carried out.

With a linear type of organization of the accounting structure, all accounting employees report directly to the chief accountant or deputy chief accountant. The accounting staff of OJSC ZMK is 8 people. The accounting department includes three departments: the material department, the settlement department and the finished products department. The number of people in the material department is 3 people, the billing department is 2 people, the finished products department is 1 person.

Accounting at OJSC Metal Structure Plant is organized in accordance with Accounting policy of this organization and regulatory documents governing accounting and reporting in the Russian Federation.

The accounting policy of OJSC ZMK is drawn up taking into account the organization of accounting and tax accounting at the enterprise.

According to the Accounting Policy of OJSC Metal Structures Plant, accounting at this enterprise is carried out using application software focused on automated maintenance accounting, with the formation of all accounting documents in electronic form. If necessary, these forms of documents can be submitted on paper.

Accounting for expenses for ordinary activities at OJSC ZMK is carried out using accounting accounts 20 - 29.

Table 2.1 presents all synthetic accounts for accounting for production costs at OJSC ZMK according to the working chart of accounts of this organization developed in accordance with Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n “On approval of the chart of accounts for accounting financial and economic activities of organizations and instructions for its application."

Table 2.1. Synthetic and analytical accounts used at OJSC ZMK to account for production costs

|

Synthetic accounting |

Analytical accounting |

|

Account 20 “Main production” |

|

|

Account 21 “Semi-finished products of own production” |

Where semi-finished products are stored |

|

Account 23 “Auxiliary productions” |

By department |

|

Account 25 “General production expenses” |

By general production costs and by departments |

|

Account 26 “General business expenses” |

By general business expenses and by departments |

|

Account 28 “Defects in production” |

By orders and production costs |

|

Account 29 Service industries and farms" |

By cost service industries |

The main direction of accounting for production costs at this enterprise is their division into direct and indirect. Synthetic and analytical accounting of these costs is different; it is carried out in accordance with the above-mentioned Order of the Ministry of Finance of the Russian Federation No. 94n.

Account 20 “Main production” at OJSC “ZMK” reflects the costs of production of the main workshops of the enterprise, this is the enclosing structures workshop and the frame structures workshop.

In account 20 “Main production”, analytical accounting is carried out for individual orders, which is necessary to formulate the cost of orders and individual types of products, as well as by types of costs for the main production, which are reflected in the costing of a unit of production. For example, for the manufacture of a purlin (a component for the construction of buildings made of light metal structures), the following types of costs are included:

1) main raw materials: channel, angle, sheet b=6, sheet b=4;

2) auxiliary materials: soil, solvent, electrodes, wire, carbon dioxide, oxygen, flammable gas;

3) fuel and energy;

4) wages;

5) deductions from wages.

In addition to the above direct costs, which are directly attributed to account 20 “Main production”, at the end of each month the balances from accounts 25 “General production expenses” and 26 “General operating expenses” are written off to this account, which are distributed in relation to the wages of the main production workers.

Accounting under account 23 “Auxiliary production” is carried out for auxiliary production shops: mechanical and tool shop, motor vehicle shop, repair and construction shop and electrical repair shop. The debit of this account collects all costs of auxiliary departments from the credit of various accounts: 10, 25, 26, 28, 70, 69 and other accounts. Cost accounting for each auxiliary workshop is carried out in the cost accounting sheet of service industries and farms. Costs in this statement are accounted for by type of product and cost item. At the end of each month, the results of the statement are transferred to the journal order No. 10. Account 23 “Auxiliary production” reflects the actual cost of products produced, work performed, services provided in auxiliary workshops, which is then written off to the debit of account 20 “Main production” or account 29 “Service production and facilities”, depending on the supply of products to the main workshops, or to service production.

The working chart of accounts for OJSC ZMK includes account 21 “Semi-finished products of own production”. Analytical accounting for account 21 “Semi-finished products of own production” at OJSC “ZMK” is carried out at the places where semi-finished products are stored. Semi-finished products are stored in production warehouses.

According to the cost estimate for account 25 “General production expenses” in

The composition of overhead costs includes the following types of costs:

Auto services;

Depreciation of vehicles, buildings, machinery and equipment, transmission devices, industrial vehicles and structures;

Payment for water, housing and fuel, electricity;

Salary;

Expenses for stationery, detergents and household needs of the workshop;

Inspection of lifting machines;

Repair of equipment, carbon dioxide cylinders;

Wastewater treatment;

Expenses for workwear and personal protective equipment;

Deductions for social insurance and accident insurance

Expenses for daily allowance within norms and above norms and other expenses.

Analytical accounting for account 25 “General production expenses are maintained in the cost accounting sheet of workshops. Each workshop separately opens its own statement. As you know, account 25 has subaccounts: “Costs for the maintenance and operation of equipment” and “General shop expenses”. Analytical accounting for these sub-accounts is carried out according to the standard nomenclature of items. At the end of the month, the cost accounting sheets of the workshops are closed and the total data reflected in them is written off to the debit of accounts 20 and 28.

The cost estimate for account 26 “General business expenses” includes the following types of costs:

Depreciation of buildings, inventory, machinery and equipment, intangible assets, other funds, structures;

Rental of property, equipment, space and stand;

Agent's commission;

Payment for water, wastewater treatment, electricity, fuel and lubricants, housing, subscription fee;

Expenses for stationery, business cards, cleaning supplies and household needs;

Salary;

Commission expenses;

Delivery costs;

Expenses for repair of equipment, carbon cylinders;

Educational services, information services;

Services for the provision of regulatory documentation, notary, bank, luggage, railway, security, postal, communications services, services for maintaining a register of shareholders;

Customs duties, declaration services, customs clearance services, certificate verification;

Contributions for social insurance and accident insurance;

Expenses for workwear;

Daily allowance expenses are within norms and above norms;

Contributions to health insurance funds: TFOMS (2%) and FFOMS (0.8%);

Parking services and other costs.

Analytical accounting of general business expenses is carried out in the statement of accounting for general business expenses, deferred expenses and non-production expenses. At the end of the month, the statement is closed and the general business expenses collected in it are written off to the debit of accounts: 20, 23, 76, 91 and other accounts. The distribution of general production and general business expenses is carried out in the statements of distribution of these expenses. They are distributed relative to the wages of the main production workers.

The chart of accounts of OJSC ZMK includes account 28 “Defects in production”. Costs for detected defects are collected in the debit of account 28, and the credit reflects the amounts collected from those responsible for the defects, or the cost of rejected products at the price of possible use, or amounts written off as losses from defects.

Analytical accounting for account 28 “Defects in production” at OJSC ZMK is carried out for orders that resulted in defects and for cost items received as a result of defective products.

Account 29 “Servicing production and facilities” at OJSC “ZMK” is used to reflect the costs of service production related to the production of products or the provision of services. The company's balance sheet includes a food shop, which is a service production facility. The costs of manufacturing the products of this workshop are reflected in the debit of account 29. The credit of account 29 reflects the actual cost of manufactured products, and the balance on this account shows the balance of work in progress at the end of the month. From the credit of account 29 “Service production and facilities” the total amount of costs is written off to the accounting accounts material assets and finished products produced by the food department.

Analytical accounting for account 29 “Service production and facilities” is carried out only in the context of cost items; accounting is not carried out by divisions, since there is only one service production.

At OJSC ZMK, production costs are recorded in order journal No. 10 and in order journal No. 10/1. In journal order No. 10, the production costs of the enterprise are reflected by element. Entries in this order journal are kept by debiting production costs from the credit of material and settlement accounts (accounts 10, 15, 16, 70 and others). It has a checkerboard shape, which provides summary data on production costs for individual elements and for costing items.

In the accounting department of the enterprise, a consolidated accounting of costs is carried out in the order journal No. 10, which is compiled on the basis of the final data from the cost accounting sheets for the main workshops and service industries and farms. The information in these statements is collected from development tables on the distribution of raw materials, materials, wages, depreciation deductions and services of auxiliary and maintenance industries, as well as from decoding sheets for other cash expenses. Journal order No. 10 also reflects internal turnover on cost accounts, for example, write-off of general production and general business expenses and services and work of auxiliary and servicing industries.

Similar to the accounting in the order journal No. 10, accounting is kept in the order journal No. 10/1, it reflects debit turnover on non-productive accounts from the credit of material and current accounts. The final data for order journal No. 10 at the end of each month is transferred to order journal 10/1. Next, the total data is transferred to the General Ledger.

The data from order journals No. 10 and 10/1 are subsequently used to calculate the cost of production by cost elements and by costing items.

The working chart of accounts for the accounting of OJSC Metal Structure Plant includes all the accounts provided for by Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n “On approval of the chart of accounts for accounting of financial and economic activities of organizations and instructions for its application” accounts. Consequently, the enterprise keeps most complete records of production costs, dividing them into main, auxiliary, general production, general economic, and service production costs, and also records the costs of defects in production and the costs of work in progress in separate accounts. In general, with the order-by-order method of cost accounting and calculating product costs used at ZMK OJSC, operational control over costs is difficult. And using all possible cost accounts helps to solve this problem to some extent.

Accounting is the most important area of work for employees of an industrial enterprise. Based on what principles should it be built? What accounting accounts are used to record business transactions in production?

Accounting as a system

Among Russian experts, there is a widespread approach according to which accounting in production should be considered as a special system. Optimally - as an information one, along with others that belong to the corresponding category (for example, with technological, regulatory systems). From this point of view, accounting in production can also be a part of the financial system, and the most important one, since it is on the basis of data generated by competent specialists with a financial education that the economic indicators of the enterprise are assessed.

Using synthetic and analytical methods, the accountant creates an information base that reflects the assets, liabilities of the company, and the results of its economic activities. Accounting as a system can be a resource useful both for enterprise managers who make various management decisions, and for the owners of the company, its shareholders, investors, and creditors.

The data contained in industrial accounting can be used when planning business development, making decisions regarding changes to the company’s management model, and setting priorities when investing in various projects.

Very strict requirements may be put forward for maintaining this type of accounting, both at the legislative level and in local regulations. Actually, this may be another confirmation of the importance of such an information collection system as accounting.

As for the sphere of production itself, even more serious attention can be paid to the regulation of accounting. The corresponding segment of the economy is related to the real sector; it controls the turnover of real assets of the enterprise, raw materials, materials, and all this requires the implementation of clearly regulated approaches to organizing accounting.

Main requirements for industrial accounting

Accounting in production is a type of activity of competent specialists, the results of which may be subject to a number of serious requirements. Thus, the information recorded in accounting should be:

Objective;

Timely;

Operational;

Verifiable.

Another significant criterion here is suitability accounting information to be read, if necessary, by a person who is not an accounting specialist. This could be, for example, an investor or shareholder who has a general understanding of accounting, but at the same time expresses an interest in getting acquainted with information reflecting the state of affairs in the business.

Main sources of data for accounting

In any industry, be it electronics or furniture manufacturing, accounting is maintained using similar types of sources. They will be classified on the following basis:

Purpose;

Duration of formation;

Level of generalization.

Based on their composition, accounting documents are divided into:

Incoming - those that come to the organization from third-party business entities;

Outgoing - which are transferred from the company to other organizations;

On internal ones - their turnover is carried out within the enterprise.

According to their purpose, accounting documents are classified:

On administrative ones - those that reflect management decisions regarding certain business transactions;

The executive ones are those that legally secure the relevant operations.

Of course, in the document flow of an enterprise, documents that are difficult to unambiguously be classified as administrative or executive can also be used. For example, these can be certificates, various calculations and registers, through which, for example, a competent specialist can reflect production costs in accounting.

Based on the duration of their formation, accounting documents are divided into:

For one-time ones - those that reflect a single business transaction;

Cumulative - those that are formed during a particular period in order to reflect information about the same type of business transactions.

Based on the degree of generalization, accounting documents can be divided into:

Primary - those that reflect the operation immediately at the time of its implementation (for example, when shipping materials);

To summary ones, which include data on several

Using the above documents, almost any business transaction can be recorded at an enterprise. In principle, they are suitable not only for such a segment as the production sector. Accounting using the listed sources can be carried out by a trade or service enterprise.

Of course, the practical application of certain documents may be determined by the peculiarities of business operations in a particular company. But the classification of sources will remain unchanged, as well as the basic principles of handling them, since accounting procedures are quite strictly regulated.

Let us now consider the main tasks of accounting at industrial enterprises.

Industrial accounting: main tasks

Again, regardless of the specific segment, be it aluminum production or furniture production, accounting at industrial enterprises is carried out in order to solve the following problems:

Formation of reliable information about the economic processes in the company, as well as the results of its economic development for a certain period;

Control over the movement of various assets and liabilities that belong to the organization, labor, financial resources- based on the validity of established rules of law;

Development of local standards;

Increasing production efficiency through analysis of key indicators recorded in accounting.

These tasks must be solved taking into account the provisions of regulatory legislation on accounting, various by-laws, clarifications of departments, and provisions of internal corporate regulations.

There are also a number of industrial accounting principles.

Industrial Accounting Principles

Effective distribution of production costs - for example, into current and capital, classification of income and expenses for specific periods.

Does a specific area of economic activity matter from the point of view of setting priorities in the organization of accounting? As a rule, there is a dependence here. Let's study its specifics.

How does accounting depend on the company's field of activity?

The industry can be divided into 2 main segments - finishing and processing.

The first type of production is characterized, first of all, by the absence of a large number of processing steps in the production of finished products. That is, in particular, accounting for the costs of auxiliary production may not be carried out in principle. The company, having extracted a particular mineral, brings it into a form suitable for delivery to the customer and organizes its transportation.

As for production costs at mining enterprises, they are usually reflected by redistribution and are subdivided, if necessary, within the framework of analytical accounting for individual structural divisions of the company.

If it is planned to process a mineral, then the production can already be classified as processing. In this case, its accounting may be much more complex in the structure and content of operations. The production of semi-finished products in this case may be a mandatory stage in the production of the finished product.

Certain nuances may characterize specific segments of the production of goods or services. So, it’s one thing to process raw materials and materials, resulting in a finished product. In this case, production accounting can be carried out by processes, sometimes by technological stages. It’s a different matter if a technically complex product is being manufactured. In this case, accounting will be more complex. The production of equipment, machines, and various controls for them involves mechanical processing and assembly of parts, spare parts, and design elements.

Enterprises that operate in the relevant segments adapt accounting to a large range of materials that are used in production. For the selection of specific accounting tools, the specifics of the management model and the basic principles of forming an enterprise with human resources may also be important.

What is important is in which structural divisions certain production operations are carried out, by whom exactly, in interaction with which specialists - inside the company or outside it.

Accounting nuances: production organization

The organization of production can be built on different principles. The most popular approaches here include threaded and non-threaded. The organization of production of the first type involves building special technological lines at the factory, using which the sequential assembly of the finished product is carried out.

Accounting for the costs of production and circulation in a flow scheme, as a rule, is easier to organize based on the strict regulation of the operations of the production of goods by the enterprise. In turn, in non-line production, equipment is installed on a group basis. Specialists working in each of the relevant departments perform part of the specified operations, after which they transfer the semi-finished product or a certain part of the product for assembly to another department of the company.

Accounting in production: postings

The most important nuance characterizing accounting in production is the use of postings. Let's consider their features.

Among the main accounting accounts that are used to generate transactions in production are 10. It reflects business transactions for various types of raw materials and supplies. The balance on it reflects the value of the corresponding resources as of a certain date. Another one in demand during formation production postings account - 20. It reflects the main business operations of production. The balance on it reflects the cost of production classified as unfinished - as of a certain date. It can be noted that the specified account reflects the costs of an industrial (accounting for production costs) enterprise. In particular, the following can be recorded here: the cost of raw materials and supplies, the salary of employees of production workshops.

If necessary, an accountant can open various sub-accounts to the main accounting accounts. Let's consider an example of industrial accounting using transactions that involve the accounts in question.

Postings in production: an example of their use in accounting

The first stage of most production is the purchase of a fixed asset. As a rule, 3 main business operations are formed here.

Accounting for invoices for materials from the supplier (Debit 10, Credit 60);

Reflection of VAT on supplies (Debit 19, Credit 60);

Reflection of the fact of payment of the invoice from the supplier (Debit 60, Credit 51);

Reflection of VAT for deduction (Debit 68, Credit 19).

Industrial accounting also involves the calculation of depreciation of fixed assets:

For main production (Debit 20, Credit 02);

By auxiliary (Debit 23, Credit 02);

For general production, as well as general economic facilities (respectively, Debit 25, 26, Credit 02).

The release of materials into production is reflected by the following entries: for main production - Debit 20, Credit 10, for auxiliary production - Debit 23, Credit 10. The calculation of salaries for employees of production shops, as well as social contributions for wages, is reflected by entries:

For employees of main production - Debit 20, Credit 70 (for social contributions - 69);

For employees of auxiliary workshops - Debit 23, Credit 70 (for social contributions - 69).

The transfer of finished goods to the warehouse is documented by posting using Account Debit 43, Credit 20. The sale of manufactured products involves reflecting the following business transactions in accounting:

Shipments (Debit 62, Credit 90.1);

Write-off of the cost of goods (Debit 90.2, Credit 43);

VAT reflections (Debit 90.3, Credit 68);

Recording profits from sales - how financial result(Debit 90.9, Credit 99);

Reflections of payment for goods from the buyer (Debit 51, Credit 62).

A non-exhaustive list of entries characterizing business transactions during the release of goods, accounting. The tasks that an accountant of an industrial company can solve are significantly broader than the example we have considered. However, the business transactions we have noted can be called typical, common for the production sector.

Production accounting, along with financial accounting, is an integral part of management accounting.

Production accounting concerns operations related to the production of self-made products, the performance of various types of work, and the provision of services within the enterprise and to third parties.

It includes:

- quantitative accounting of production volumes, interesting to management and employees of production departments;

- accounting for operations to calculate cost per unit of production, which is necessary mainly for financial departments and company managers.

The main goal of production accounting is to control production costs to identify opportunities to improve the efficiency of the company as a whole.

How are production costs recorded?

Modern production accounting, as a rule, includes accounting for costs and income according to the following analytics:

- by their types;

- by department;

- by type of product (product groups).

In various industries and industries, the object of cost accounting can be products, their parts, a group of homogeneous products, a separate order, the volume of production as a whole for the enterprise or in its individual sections. The choice and features of accounting objects are often determined by the specifics of the business.

All accounts that take into account production costs in transactions are active. Expenses of the main production are maintained on account 20, general production and general business expenses - on accounts 25, 26.

At the end of the month, accumulated expenses on the debit of accounts 25 and 26 are transferred to the debit of accounts and/or, while the accounts are closed and have a zero balance. On account 28, servicing production is taken into account, on account 29.

Basic accounting operations for production

The most important accounting transactions for production include:

Main production costs

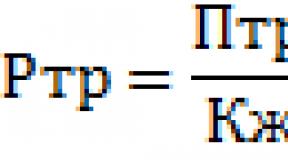

They are accounted for in the corresponding debit, the debit of which reflects the expenses, and, and, (94), and other basic expenses included in the cost directly. One way to distribute costs is.

Part of the expenses, general shop and general business expenses (accounts 25, 26), attributable to the production cost of finished products (), is also written off here. The credit of this account takes into account (10), as well as the completion of production cycles for semi-finished products sold externally (21).

Expenses of auxiliary production

Expenses of auxiliary production (account 23) include the costs of energy, repair, instrumental facilities, costs of technical control, etc., which are reflected in the same way as on account 20.

Unfinished production

WIP - materials, parts, products, semi-finished products and other labor products that have entered production, but have not yet gone through all the processing stages provided for in the technological cycle and cannot be used for consumption for their intended purpose. The cost of work in progress at the end of the month is determined by the balance of accounts 20, 23 and 29.

Overhead costs

General production expenses (account 25) take into account the costs of maintaining, servicing and/or repairing main and auxiliary workshops and departments that are not related to specific types of products: maintenance and operation of in-shop equipment and transport, wages for workers servicing the workshop, tool wear, electricity costs for workshop work, etc.

General running costs

General expenses (account 26) reflect the costs of managing the enterprise as a whole, which cannot be attributed to any specific divisions and types of products: maintenance of buildings and property of the plant management, plant laboratories, expenses for administrative and economic needs, remuneration of administrative personnel, and etc.

General production and general business expenses at the end of each month are distributed among the divisions of the enterprise and types of products based on the selected base for distribution.

Marriage

Defects (account 28) – losses in production due to the release of products that do not meet the requirements of standards (specifications), which cannot be used for their intended purpose or are possible, but with restrictions and loss in price and quality.

Marriage can be internal or external, reparable or irredeemable, compensated or unredeemed.

Finished products

Expenses of service industries

Expenses of service industries and farms (account 29) are not related to the main production (housing and communal services, preschool institutions, healthcare institutions, culture, catering, sanatoriums, rest homes, etc.), however, they are designed to solve social issues and are necessary to maintain and, if necessary, , restoring the ability to work of employees.

Provided raw materials

Waste

Waste – materials, substances or items generated as a result of production activities that are not suitable for further use or external sale and require processing or disposal. Reflected on account 10.

Cost accounting

Product cost is the sum of all enterprise costs for the production of one unit of product. In addition, the cost of semi-finished products of the main production, products of auxiliary, service, ancillary and by-products, as well as the entire volume of commercial products of the enterprise can be calculated.

The process of calculating the cost per unit of production is called costing. Account 20 is used to determine production costs.

JSC Imstalcon has been a leading enterprise in the production of building metal structures for many years. The production of metal structures began in 1963 - from the moment the plant went into production. In addition to standard building metal structures, the plant specializes in the production of complex, non-traditional metal structures. KZMK produces the following structural metal structures: frames of buildings and structures in all sectors of the national economy, structures of residential and public buildings and special structures, metal structures of road, railway and pedestrian bridges, non-standard equipment for most branches of industrial production, as well as technical and medical oxygen.

The main technical and economic characteristics of the enterprise’s activities for the period 2005-2006 are presented in Appendix B.

Imstalkon JSC carries out the following types of work (services) in the field of architectural, urban planning and construction activities, for the manufacture and installation of steel structures:

- 1) Design work for construction:

- - architectural design of buildings and structures of the first level of responsibility;

- - construction design and construction;

- - design of engineering systems and networks.

- 2) Expert works;

- 3) Production of building materials, products and structures:

- - production of building materials and products (except for window and door blocks).

- - ventilation and plumbing equipment.

- - production of building structures: tower-mast type, chimney pipes;

- - tanks and containers with a volume of up to 5000 m 3 ;

- - tanks and containers operating under pressure or intended for storing explosive and fire hazardous and environmentally harmful materials;

- - load-bearing and enclosing;

- - technological metal structures and their parts.

The main activity of the enterprise JSC Imstalcon Karaganda Metal Structures Plant is the production of metal structures. Dynamics of production of metal structures for the period 2000-2006. presented in Figure 3.

Figure 3. Dynamics of production of metal structures at the enterprise Imstalcon JSC Karaganda Metal Structures Plant

From Figure 3 it can be seen that in 2002, the production of metal structures changed significantly, which affected the profit of the enterprise, but in the subsequent period from 2003 to 2006, the dynamics of output increased, which positively characterizes the production activity of the enterprise.

Structural changes in production for the period 2005-2006. are given in table 1.

Table 1. Structure of commercial products of Imstalcon JSC Karaganda Metal Structures Plant for 2005 and 2006. (in percentages)

As can be seen from the calculations made (Table 1), a significant share in the structure of commercial products is occupied by the production of metal structures - 97.87% in 2005, 98.37% in 2006. A small share remains for the production of oxygen, heat energy and other materials. As can be seen from the table, the structure of commercial products has not changed significantly over the two years.

Product cost is the current costs of an enterprise for the production and sale of products, expressed in monetary terms.

As has already been revealed, for the Karaganda Metal Structures Plant (hereinafter KZMK) Imstalcon JSC, the main product is the production of metal structures to order.

Cost calculation at each enterprise has its own characteristics and is compiled in accordance with the specifics of production. At the analyzed enterprise JSC Imstalcon Karaganda Metal Structures Plant, the cost of production depends on the cost of producing each order.

To account for production costs, this enterprise uses the order-based costing method. At the same time, the cost of manufactured products at the Imstalcon JSC KZMK enterprise reflects:

- - cost of materials (this is metal and auxiliary materials, which include argon, oxygen, electrodes, wire, carbon dioxide, propane, flux, soils, solvent, lumber);

- - cost of electricity;

- - basic wages of key workers and specialists;

- - social tax from the basic salary.

All of the above costs are direct, because There is a direct payment for each order.

The cost of goods manufactured also includes the following overhead costs:

b. depreciation of buildings and equipment;

c. remuneration of engineering and technical workers of workshops, service personnel (technicians);

d. social tax on the transferred salary;

e. labor protection (working clothes, soap, milk)

These costs are included in a group that is not calculated directly for each order, but is charged as a percentage.

To calculate the cost of the order, the planned cost is displayed. For each order there is a direct calculation:

- - metal based on the technical specification attached to the received order;

- - auxiliary materials in accordance with the standards developed by the chief specialists and approved by the chief engineer of the plant;

- - electricity, which is calculated based on the planned volume of energy consumed by the main production (processing shop with a metal warehouse, assembly and welding shops, equipment and manufacturing centers, RMC) and is divided by the planned volumes of output.

- - average wages of main workers, which is derived from labor costs by type of metal structures per 1 ton;

- - wages of specialists according to salaries and other accruals, which are distributed according to the volume of planned work;

- - social tax on wages of key workers and specialists, which is calculated according to salaries and other accruals.

The main workers include: processors, markers, assemblers, welders, slingers, overhead crane operators, metal cleaners, gas cutters, painters, markers, quality control inspectors, flaw detectors.

The specialists include: designers, production maintenance technologists, and computer processing center operators for processing work orders.

All listed costs are summed up and direct costs are obtained. The remaining costs are overhead.

Expenses are accrued for the planned volume of work (orders) in total terms. As production volumes increase, overhead costs decrease. In costing for orders, overhead costs are reflected as a percentage of the main cost. wages, which is to order. At the plant, the overhead cost for main production is 31.7. The main production at the plant includes: a metal processing shop and warehouse, assembly and welding shops, manufacturing and manufacturing centers, and partially RMC.

In addition to the main production, the plant has auxiliary services that are not involved in the production of products, but they are engaged in servicing the main production. These services include: the EMO service, which includes a control center, a maintenance and technical equipment repair area, an oxygen shop, a compressor station; RSC; garage; partially RMC. Direct costs and overhead costs are also collected for support services. These costs, according to established principles, are distributed to the main production.

The distribution of costs of support services is carried out according to the following principle:

- 1. Oxygen shop - costs are distributed according to certificates of oxygen production and oxygen sales. The distribution of the remaining oxygen is carried out according to the number of gas-cutting stations located in the main workshops and according to orders in proportion to the produced commercial products;

- 2. RMC - according to the standard consumption of compressed air by equipment located in workshops. For orders, distribution is made in proportion to the volume of work completed;

- 3. PSU - distribution of space heating costs is carried out in proportion to their cubic meters;

- 4. Maintenance and technical equipment repair area - costs are distributed among the main workshops in inverse proportion to the residual value of the equipment under their control;

- 5. Garage service - costs are distributed according to the following principle:

- - costs of passenger vehicles are included in the item “Period expenses”;

- - the costs of other vehicles are included in the cost of imported basic and auxiliary materials;

- 6. RSC - costs are distributed according to wages according to the approved estimate among the structural divisions of the plant;

- 7. RMC - costs are distributed according to the volume of work performed according to requests received from structural divisions.

All costs of support services are included in the main production in the form of overhead costs. In addition to direct costs and overhead costs, the cost includes the costs of administrative and management personnel, which are called “period expenses.” They also collect direct costs and overheads. Period expenses are shown as a percentage of production costs, which are made up of direct costs and overhead costs. Period expenses are 11% of production costs.

Based on the costs, the price of 1 ton of metal structures is determined; it consists of the total costs and plus profit, which is 8% of the total costs.