Linear depreciation of fixed assets formula. How is depreciation calculated? Postings for calculating depreciation using the straight-line method

We understand the concept of depreciation. Here you will learn how to calculate depreciation of fixed assets. From 2002 to the present day, in accounting there are the following methods of calculating depreciation: linear method of calculating depreciation, reducing balance method, method proportional to the volume of output, as well as the method based on the sum of the numbers of years of the term beneficial use. In this article we will analyze these 4 methods of calculating depreciation with examples.

The calculation of depreciation charges for fixed assets involves the use of the original or residual value and the depreciation rate of fixed assets. The initial cost is the cost at which the object was accepted for accounting upon receipt by the enterprise. Read more about the receipt of fixed assets. The residual value of fixed assets is the difference between the original cost and accrued depreciation.

General formula for calculating depreciation charges:

Cost (original or residual) * depreciation rate / 100%.

Calculating the rate is very simple; to do this, you need to divide all depreciation (taken as 100%) by. Then you can calculate the amount of depreciation for the past year, that is, multiply the original cost by the rate and divide by 100%. How to calculate depreciation charges for a month? To do this, all that remains is to divide the amount received by the previous action by the number of months in the year.

1. Straight accrual method (linear) assumes that the functional utility of an asset depends on the time of its use and does not change throughout its useful life, i.e. A constant amount of depreciation is charged over the entire useful life of the asset.

With this method, monthly depreciation deductions are made in the same amounts throughout the entire useful life of fixed assets.

When applying the linear method, the amount of depreciation accrued for one month in relation to an object of depreciable property is determined as the product of its original (replacement) cost and the depreciation rate determined for this object.

When applying the linear method, the depreciation rate for each item of depreciable property is determined by the formula:

K = (1/n) x 100%,

where K is the depreciation rate as a percentage of the original (replacement) cost of the depreciable property;

n is the useful life of a given depreciable property item, expressed in months (years).

Example. An object worth 120 thousand was purchased. rub. with a useful life of 5 years. The annual depreciation rate is (1/5)x100%=20%.

The annual amount of depreciation charges will be:

120,000 x 20%: 100% = 24,000 (rub.)

2. Reducing balance method. With this method, the annual amount of depreciation charges is determined by the residual value of the fixed asset item at the beginning of the reporting year and depreciation rates calculated based on the useful life of this item and the acceleration factor established in accordance with the legislation of the Russian Federation. For movable property that constitutes the object of financial leasing and is classified as the active part of the operating system, in accordance with the terms of the leasing agreement, the acceleration factor cannot be higher than 3. Example. P The initial cost of the object is 100,000 rubles; useful service life - 5 years; annual depreciation rate - 20%; increasing factor - 2.

Depreciation calculation:

1st year: 100,000 x 40% (20 x 2) = 40,000 rub. (residual value - 60,000 rubles);

2nd year: 60,000 x 40% = 24,000 rub. (residual value -36,000 rub.);

3rd year: 36,000 x 40% = 14,400 rubles. (residual value -21,600 rub.);

4th year: 21600 x 40% = 8640 rubles. (residual value -12960 rub.);

5th year: 12960 x 40% = 5184 rubles. (residual value -7776 rub.).

After depreciation has been calculated for the last year, the fixed asset retains a residual value that is different from zero (in this example, RUB 7,776). Typically, this residual value corresponds to the price of the possible capitalization of materials remaining after the liquidation and write-off of fixed assets.

3. Depreciation method based on the sum of the numbers of years of useful life. This method is also accelerated and allows depreciation payments to be made in the first years of operation in significantly larger amounts than in subsequent years. This method is used for fixed assets, the value of which decreases depending on their useful life; obsolescence sets in quickly; the cost of restoring an object increases with increasing service life. This method is advisable to use when calculating depreciation on computer equipment and communications equipment; machinery and equipment of small and newly formed organizations whose load on fixed assets falls on the first years of operation.

When writing off the cost by the sum of the number of years of its useful life, the annual amount of depreciation charges is determined based on the original cost of the fixed asset and the annual ratio, where the numerator is the number of years remaining until the end of the service life of the object, and the denominator is the sum of the number of years of the service life of the object.

Example. An item of fixed assets was purchased at a cost of 350 thousand rubles, with a useful life of 6 years. The sum of the numbers of years of service life is 21 years (1+2+3+4+5+6). In the first year of operation of the specified object, depreciation may be charged in the amount of 6/21 or 28.05%, which will be approximately 98.18 thousand rubles; in the second year – 5/21 or 23.8% (83.3 thousand rubles); in the third year - 4/21 or 19.09% (66.82 thousand rubles), etc.

4. Method of calculating depreciation depending on the volume of production or work(proportional to production volume). In this case, the annual amount of depreciation is determined by multiplying the percentage calculated when registering a given object as the ratio of its initial cost to the expected volume of output of products or work over its useful life by the indicator of the actual volume of production or work performed for a given reporting period.

Example. The cost of the car is 65,000 rubles, the estimated mileage of the car is 400,000 km. In the reporting period, the car's mileage was 8,000 km, the amount of depreciation for this period will be 1,300 rubles (8,000 km x (65,000 rubles: 400,000 km)). The amount of depreciation for the entire useful life of the fixed asset is 65,000 rubles (400,000 km x 65,000 rubles: 400,000 km).

Everything that is used by an enterprise in production and, ultimately, brings profit, wears out. The cost of fixed assets is transferred in parts to the price of manufactured products. This process is commonly called depreciation.

Tax legislation of the Russian Federation states: depreciation is mandatory for all commercial enterprises registered in our country. Russian accounting standards define four main methods for calculating depreciation. Which one to choose, the heads of organizations have the right to determine independently, unless otherwise provided by law. This choice must certainly be reflected when developing accounting policies.

Linear method

One of the most common calculation methods. About 60-65% of enterprises use the straight-line method of calculating depreciation. The reason for this popularity is that this method is the most understandable and easy to use: deductions occur linearly, that is, an equal part of the cost of any type of fixed capital is transferred monthly to the cost of goods or services, without additional conditions and reservations.

Organizations begin to transfer the cost of the depreciation item to products from the first day of the month following the month in which the equipment began to be used. Depreciation charges end on the first day of the month following the month in which the cost of the equipment was completely written off. Or when the object was removed from the taxpayer’s depreciation property, regardless of the reasons.

IN Tax Code Russian Federation, which says how to calculate depreciation using the straight-line method, stipulates one more point in addition to those listed: if the property of your enterprise was given under a contract for free use to another individual entrepreneur, or was under reconstruction, or was mothballed, then deductions begin on the first day of the month, following the month in which the property or property was returned to the capital of your company. In this case, it is necessary to determine the restored value.

The procedure for calculating depreciation using the linear method

- First, we find out the useful life of the equipment (SUI). This can be done by referring to the Tax Code of the Russian Federation, Art. 258. Depreciation groups are defined there, and it is said that the classification of fixed assets that are included in them is approved by the Government of the Russian Federation. If the equipment used is not indicated in the groups, the taxpayer has the right to independently establish the SPI. At the same time, he must adhere to the technical specifications and/or recommendations of the manufacturer. Another caveat is that if the manufacturer does not purchase new equipment, he can reduce the TPI by as many months as it was used by the previous owner.

- Now we need to calculate the depreciation rate. To determine this indicator, use the following formula: K = 1/n * 100%, where K is the depreciation rate we are looking for; n is the already found SPI of the equipment, expressed in months.

- Final stage. We directly calculate the depreciation of equipment using a linear method. To do this, we multiply the initial price of the depreciation object by the previously obtained depreciation rate.

OS calculation example

In order to understand this simple calculation principle, let’s look at how depreciation is carried out using the linear method, as an example. Let's assume that we are engaged in tailoring. To increase productivity, we bought a new sewing machine and paid 24,000 rubles for it. The new equipment began to be used in March 2012.

- According to the Tax Code of the Russian Federation, a sewing machine belongs to the third depreciation group. This means that SPI = 3-5 years, 36 and 60 months, respectively. Based on the specifics of production, we expect that we will use the equipment for 40 months.

- Let's calculate the depreciation rate. Based on the above formula, we get:

- 1/40*100%=2,5%

- Thus, the depreciation of one sewing machine is equal to: 24000 * 2.5% (0.25) = 600. It turns out that every month 600 rubles will be charged on clothes sewn by our company. This will continue until July 2016, unless force majeure occurs and the machine fails.

The resulting indicator is used when calculating the costs of production and sales of the produced product or service (in order to reduce the tax imposed on profits). Without it, it is impossible to determine property tax or calculate the liquidation value of an enterprise. In addition, the amount of depreciation is taken into account in the total investment costs of the project.

Fixed assets and intangible assets are the property and intangible assets of an organization that are used in its activities and are capable of generating income for the organization from their ownership and use for a long period of time - at least 1 year (machines, tools, cars, real estate, patents for inventions, licensing or copyrights, trademarks, etc.).

Over time, machines become obsolete, tools wear out, buildings are destroyed, old patents are replaced with new, more technologically advanced ones. And if, for example, you want to sell your machine or building, then the question arises - what is its real value, taking into account active use? A 3-year-old Gazelle cannot cost the price of a new one. So we come to the need to take into account the depreciation of a fixed asset (intangible asset) or its depreciation over time. Depreciation will help us with this.

What is depreciation?

Depreciation is the process of periodically transferring the initial cost of a fixed asset or intangible asset to manufacturing, selling, or general expenses, depending on how the asset is used.

There are several methods of depreciation, but legal entities using the simplified tax system should probably choose the simplest one - the linear method of depreciation.

The straight-line method is that over the entire useful life of a fixed asset or intangible asset, it is written off in equal shares. Depreciation is charged monthly, starting from the next month after the property is put into operation, and until the original cost of the fixed asset or intangible asset is fully amortized.

How can we calculate depreciation?

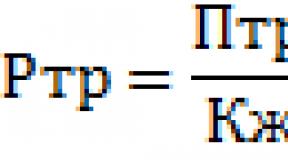

As you can see from the formula, you will need to determine the original cost and useful life to calculate the monthly depreciation amount. If there are no problems with the amount of the initial cost, then determining the period of use is sometimes a difficult task.

Determining the useful life

For an intangible asset, the useful life is determined by the company itself. This is the period during which the intangible asset will be used and thereby generate income.

For fixed assets in accounting, an enterprise can also set the period of use independently, but it would not be amiss to coordinate this period with already developed standards and classifiers.

Therefore, to determine the useful life, we recommend using a classifier of fixed assets by depreciation groups, approved by Government Decree No. 1 of 01/01/2002.

If a fixed asset belongs to several depreciation groups, we recommend choosing a useful life from the range of the groups to which it belongs, based on the expected service life of the fixed asset.

Thus, it will be possible to obtain the monthly depreciation amount.

If it is necessary to determine the amount of depreciation for a period, for example, as of 01/01/2019, then you should first determine the date of commissioning, and then calculate how many monthly depreciation amounts should have been made. Thus, the monthly depreciation amount can be multiplied by the number of months from the date of commissioning.

Calculation example

Romashka LLC bought a passenger car for 600,000 rubles on 02/22/2016 and put it into operation on 03/10/2016.

As of 01/01/2019, it is necessary to determine the amount of depreciation for the period of use.

According to the classifier, passenger cars belong to the third depreciation group with a useful life of 3 to 5 years. We choose, for example, 5 years - the car is reliable, and we are going to use it for a long time.

The annual depreciation rate is equal to: 100% / 5 years = 20%

The annual depreciation amount is 600,000 rubles * 20% = 120,000 rubles.

In business, one of the most important concepts is depreciation. At its expense, the funds spent by the company on the purchase of this or that equipment are compensated. One of two methods can be used to calculate depreciation.

Basic provisions

Depreciation in taxation is the transfer of costs incurred as a result of a purchase to the cost of goods and services produced by the enterprise. At its expense, funds spent on the purchase of equipment or construction of buildings are compensated.

Deductions in this area of the economy are made during the entire time of use of the device. The starting point is the moment of putting the equipment on balance, the final point is its removal. It does not matter whether the equipment was purchased new or used.

The accrual procedure is approved by art. 259 of the Tax Code of the Russian Federation. The funds received during settlements are recorded as the company's losses and are not subject to taxation.

There are two methods for calculating depreciation - linear and non-linear. The owner of the enterprise is free to choose the method. The exception is acquisitions related to buildings and structures, which belong to 8-10 depreciation groups. They are subject to the linear method only.

The previously selected method could not be changed to another. Since the beginning of 2014, in connection with amendments to the law, the organization has the right to cancel the linear method at any time and replace it with another. But before that, it is necessary to make appropriate amendments to the regulation accounting policy companies. The transition from the nonlinear method is possible once every 5 years.

Linear method

This method is preferable to use if the equipment will be used for the entire period of operation. This implies that the profit received from his work will also be the same. With this method, the cost expended is written off evenly in the same monetary amount.

The method assumes that the amount of accruals will be equal to the product of the depreciation rate and the cost of the purchased equipment or object recorded in the documents.

To calculate the coefficient, the following formula is used:

K=(1/n)100% , Where:

- TO – depreciation coefficient. This number is expressed as a percentage,

- n – time of its operation. Measured in months.

For example, an organization purchased equipment worth 50,000 rubles. The service life is 5 years, that is, 60 months.

The monthly coefficient for calculations will be equal to:

(1/60)100 = 1.67.

In this case, the amount of monthly deduction for the purchase of equipment will be:

50,000*1.67%= 835 rubles.

This amount of depreciation charges will be taken into account over 60 months of use of the equipment. Upon the arrival of this period, even if the machine is in working condition and is not written off, depreciation charges will not be made or will be equated to zero in the documentation.

Pros and cons of the linear method

Like any method, the linear method has its pros and cons. Based on them, it is necessary to decide whether it is worth choosing it as the main method.

Pros:

- Simplicity. The calculation is made only once - immediately after the property is added to the balance sheet. The amount received is valid for the entire period of operation;

- The cost is written off quite accurately and is easily traced due to the same amount;

- Deductions are made for each object separately. For example, if 2 or 3 different machines were purchased at the same time, the depreciation rate and the amount of deductions for each are calculated separately;

- Costs are transferred evenly to production costs.

Flaws:

- Not suitable for equipment with a short service life;

- Due to the decrease in productivity during operation, the equipment will require significant costs for modernization and repair. At the same time, the write-off of funds to pay off its cost will proceed evenly;

- Not suitable for enterprises that frequently update production assets;

- The amount of tax paid during the use of the object will be significantly higher than with a non-linear one.

Nonlinear method

The second method is nonlinear. About 30-40% of enterprises use it in their activities. According to paragraph 5 of Art. 259 of the Tax Code of the Russian Federation, depreciation is calculated based on the balance of the original cost of the object and the service life determined by the enterprise based on a number of factors.

First you need to determine the depreciation rate. It is determined by the following formula:

K=(2/n)100%, Where:

- K – depreciation coefficient. Also expressed as a percentage.

- n – the period during which the equipment will be useful.

After the residual value of the depreciable property reaches 20% of the original value, depreciation will be calculated using the following method:

- The balance for the value received is fixed and is considered the base for calculations.

- Depreciation per month is determined as the quotient between the base cost and the number of remaining months of operation of the facility.

Let's try to figure it out with a specific example:

A machine worth 25,000 rubles was purchased. The service life is 3 years or 36 months. An amount equal to 20% of the cost of the machine – 5,000 thousand.

In the first months, depreciation is calculated as follows:

- The depreciation rate is determined: K=(2/36)*100%= 5.56;

- First month: 25,000*5.56%= 1390 rubles.

Second month:

- Residual amount at the beginning of the month = 25,000 – 1390 = 23,610 rubles;

- Depreciation calculation = 23610 * 5.56% = 1312.71 rubles.

The remaining months are calculated according to the same principle.

After the balance at the beginning of the month is 5,000 rubles, deductions for the remaining service life will be:

5 000/n ost, where:

n rest – the duration of use of the equipment from this moment until the end of its useful life. Expressed in months.

For example, we received the balance of 5,000 rubles 27 months after the equipment was put into operation. Therefore, n rest will be: 36 – 27 = 9 months.

In this case, the amount of accruals will be the same for all subsequent months of use.

Charges for used equipment

The property received at disposal can be not only new, but also previously used. In this case, it is necessary to find out from the previous owner the actual period of use of the equipment and its useful life. Then you need to find the difference between these two numbers.

For example, the useful life of the machine is 72 months; previously it was used for 20 months. Thus, the difference will be 72 – 20 = 52 months.

The resulting figure will be the useful service life for this equipment. It will form the basis of calculations.

Otherwise, the owner of the enterprise chooses the method of calculating depreciation and applies it according to the formulas described above.

Terms and procedure for accrual

Deductions begin after the equipment is delivered to the balance sheet. The first accrual is made from the first day of the month following the recording of the equipment and lasts until the end of the useful life of the equipment.

For example, a machine was purchased whose service life is 5 years, that is, 60 months. It was placed on the balance sheet on May 15, 2010, and accruals on it begin on June 1, 2010. In May 2015, the last accrual for the machine will be made, since 5 years have passed since it was added to the company’s balance sheet.

A few words about the procedure and rules used in calculating charges.

- To begin deductions, the purchased equipment is placed on the enterprise’s balance sheet. Equipment that is not registered is not subject to depreciation charges;

- Financial transactions related to depreciation are carried out monthly, regardless of financial results firms;

- Depreciation must be taken into account in the relevant tax period;

- Deductions are suspended if the object is mothballed for more than 3 months or long-term repairs are carried out (repair period is more than 1 year).

Video: How to calculate depreciation

Candidate of Economic Sciences, N.D. Klikunov, analyzed two methods for calculating depreciation - the compound interest method and the linear method, and showed that the linear method is not perfect.

Depreciation charges are the main way to compensate for the costs of purchasing certain equipment used in production. This amount is calculated in two ways - linear and nonlinear. Depreciation deductions occur throughout the entire service life of the equipment specified in the documents and begin immediately after it is placed on the balance sheet.