VAT report for the year due date. Deadline for filing a VAT return

VAT, or value added tax, is one of the most important taxes. There are certain dates when each taxpayer needs to report: submit returns and pay taxes. When is the deadline for filing a VAT return?

It should also be noted that they have been extended for 5 days. If the 25th falls on a day off, then the deadline for submitting declarations is extended to the next working day. For example, in 2015, April fell on a day off—Saturday. Accordingly, the deadline for filing a VAT return has moved to Monday, the 27th.

What has changed in declarations in recent years?

In 2015, the tax inspectorate proposed, or rather, obliged taxpayers to submit returns electronically.

To do this, each individual entrepreneur and each organization working with VAT must purchase keys that contain information about the declarant. The Crypto-pro program must be installed on the computer, which will read the encrypted signature, verify it and send it further. As well as the Crypto-ARM program, which allows you to archive the sent file.

Sent declarations are monitored by a single portal, which identifies all violations of the declarant. Information is immediately sent to him by e-mail about what discrepancies are being discussed. Regardless of the size of the file being sent, all entries must be made.

Persons providing services as intermediaries may not work with VAT, but in any case must issue invoices.

Only tax agents provide a paper declaration, and not all persons.

Electronic reporting and electronic invoice are different things and should not be confused. Filing declarations electronically is the responsibility of the declarant, and submitting an electronic invoice is his right.

Deadlines for submitting VAT reports

The declaration itself is a document required to be submitted by all taxpayers. There are other VAT reports that have their own deadlines:

- VAT – numbers quarterly.

- Invoice journal – quarterly on the 20th.

- Declaration of indirect taxes- On the 20th, once a quarter.

Failure to submit a tax return on time entails penalties ranging from one thousand rubles.

It is advisable for an accountant to have a calendar that will remind him when the reporting date is due.

How to submit a VAT return?

Paper media: Word, Excel - have long since sunk into oblivion. You shouldn’t even try to submit a paper return. They simply won't accept her.

Each declaration must be signed with an electronic digital signature, which can be ordered at any certification center. The appropriate software must be installed on the computer.

After signing the document, it can be sent to the tax authority. There is a single portal for accepting VAT returns. In case of small discrepancies, the program will automatically generate a report for you.

You can see errors in the report, correct them and resend the declaration.

It is advisable to send declarations several days before the reporting period. Otherwise, if errors are discovered, you simply will not have time to correct them, which will entail a fine.

Prepare your declarations in advance and submit them. The declaration is considered submitted if it was sent on the 25th before 24.00 Moscow time. Conscientious taxpayers relieve yourself of unnecessary expenses and responsibilities to once again communicate with the tax inspector.

What are the deadlines for filing a VAT return in 2017? Have these deadlines changed? A table with the current deadlines for filing a VAT return in 2017 is given in this article.

Who needs to submit a VAT return in 2017

The VAT return in 2017 must be prepared by organizations and individual entrepreneurs, including intermediaries, which (clause 5 of Article 174 and subclause 1 of clause 5 of Article 173 of the Tax Code of the Russian Federation):

- are recognized as VAT payers;

- are tax agents for VAT.

At the same time, the following may not submit a VAT return in 2017:

- organizations and individual entrepreneurs using the simplified tax system, unified agricultural tax, UTII or patent taxation system;

- organizations exempt from VAT (whose revenue excluding VAT over the last 3 months did not exceed 2 million rubles);

- taxpayers submitting a simplified tax return (who have no VAT transactions or no movements in current accounts).

Deadlines for submitting the declaration in 2017: table

Submit your VAT return for 2017 no later than the 25th day of the month following the reporting quarter. We list the deadlines in the table.

Deadline for submitting a log of received and issued invoices in 2017

In 2017, intermediaries acting in the interests of third parties on their own behalf are required to submit logs of received and issued invoices. They are:

- commission agents;

- agents;

- forwarders (involving third parties without their own participation);

- developers (involving third parties without their own participation).

The deadline for submitting the log of received and issued invoices is no later than the 20th day of the month following the expired quarter. Below in the table we show the deadlines for submitting the journal of received and issued invoices in 2017.

Delivery method in 2017

VAT returns must be submitted to the Federal Tax Service exclusively in electronic form through authorized telecom operators. And this has nothing to do with the number of employees of the organization and applies to everyone who must prepare VAT returns. Paper declarations are not considered submitted in 2017 (letter of the Federal Tax Service of Russia dated January 31, 2015 No. OA-4-17/1350).

VAT is the only one federal tax, reporting on which is not cumulative, from January current year, and for each quarter separately. In most cases, tax returns are submitted by taxpayers via telecommunications networks, new form The form has been valid since 2015.

What are the features of the declaration?

The updated VAT report from 2016 is not limited to the fact that it indicates the amount of calculated tax and the calculation procedure tax base. As an addition, the declaration form began to include data from the purchase book and sales book for the reporting period (sections 8 and 9).

Each line of sections indicates:

- INN/KPP of the counterparty;

- initial data on the registered invoice (number, date);

- time of registration of received goods/services;

- amount of income/sales;

- VAT amount.

When transmitting the declaration electronically to the tax authority, the information presented in the report is automatically verified. Firstly, the relevance of the partner’s TIN in the registers of legal entities is monitored. Secondly, entries in the purchase/sale books of both counterparties are compared.

Such a system for submitting a VAT return allows the tax inspector to carry out desk audit already at the stage of receiving the report.

Remember: It is necessary to submit a VAT return to the territorial tax authority where entity is registered. For individual entrepreneurs, the place of submission of VAT reports coincides with the place of permanent registration.

For whom is it necessary to submit a declaration?

All the subtleties concerning one of the most complex taxes - VAT - are set out in Chapter 21 of the Tax Code of the Russian Federation. This clearly outlines the circle of business entities that are required to regularly submit VAT returns to the fiscal authorities. These include:

- legal entities, regardless of their form of ownership and organizational and legal form, using OSNO in their work;

- individual entrepreneurs working under the general system;

- subjects falling under the status of tax agents;

- organizations and individual entrepreneurs applying the “imputed” regime or simplified tax system – in situations provided for by tax legislation.

VAT reporting for “special regimes”

The use of simplified tax schemes - simplified tax system, UTII, unified agricultural tax, PSN - is the basis for releasing the taxpayer from the obligation to account for and pay VAT. But in a number of cases, “simplified” and imputed tax payers must, along with the reports required for them, submit a VAT return.

UTII and OSNO

If an LLC or individual entrepreneur combines two tax regimes in its work - UTII and OSN, then it must not only use separate accounting business transactions, but also to generate a VAT return on time. The deadline for submitting the report and paying the payment order for the amount of tax declared in the report does not differ from other taxpayers - the 25th day after the end of the quarter.

USN and Unified Agricultural Tax

When switching to a special tax regime, taxpayers exempt from VAT are required to pay tax and submit regular reports on it in the following cases:

- if the LLC/IP on the simplified market issues an invoice to the buyer with the allocation of VAT (except for intermediary transactions);

- in tax agency.

You should know: issuing an invoice and allocating VAT exempt suppliers does not deprive the buyer of the right to claim a deduction.

When a “simplifier” conducts intermediary activities on his own behalf, without being tax agent, he is obliged, before the 20th day of the month after the end of the quarter, to submit to the tax authority a journal of registered invoices, which replaces the VAT declaration.

Filing reports and paying VAT

The deadline for submitting the declaration according to the general regulations prescribed by Article 174 of the Tax Code of the Russian Federation is 25 days after the end of the tax period (quarter). If the 25th day of the next month, when the period for preparing and submitting the VAT report expires, falls on a holiday or weekend, then the taxpayer has the opportunity to submit the declaration on the first working day. This rule is mandatory for all organizations and individual entrepreneurs who are subject to VAT payer obligations.

The VAT return must be submitted electronically and must comply with the approved tax service format. Submitting a report in paper form is permitted, as an exception, for tax agents who are not VAT payers.

Important: Submitting a VAT return on paper is a violation of the provisions of Article 174, paragraph 5, which entails recognition of the report as not submitted and the accrual of penalties, and the possibility of blocking the taxpayer’s current account. The minimum fine for a “paper” report is 1000 rubles.

When should you pay VAT?

VAT must be paid within the deadline specified for filing a tax return - the 25th of the quarter following the tax period. Together with the submission of the VAT report, it must be sent to the bank payment order for an amount equal to 1/3 of the calculated tax. The remaining 2/3 of VAT is paid in subsequent months in equal installments.

The one-third rule can be adjusted upward by the taxpayer himself. The law allows at the end of the tax period to pay the entire amount of calculated VAT at once, or to transfer most of the tax to the budget in the first month, and transfer the rest later.

Subjects economic activity , using special modes and those obliged to pay VAT in special cases, pay VAT in full, without breaking down by month, on the day the declaration is submitted.

For tax agents cooperating with foreign organizations and those purchasing goods/services from them, there is a requirement to pay VAT at the time of transfer of money to the supplier. Simultaneously with payment for the goods, it is necessary to submit a payment order to the bank for the amount of VAT on the amount of the payment.

Other tax agents(tenants of municipal property or sellers of confiscated property) pay VAT within the period specified by tax legislation. They are also allowed to split the payment into three equal parts.

Attention: To ensure that the paid VAT does not “hang up” as an unidentified payment, it is necessary to ensure that all fields of the payment order are filled out correctly. The payer must especially carefully check the accuracy specified by the KBK and details of the tax authority.

Sanctions for late filing of returns and payment of VAT

In case of delay in submitting a VAT report, penalties are calculated from the amount of tax calculated for payment and amount to 5% of the VAT amount on the declaration for each calendar month of delay. In this case, the minimum fine is 1,000 rubles, and the maximum is 30% of the tax calculated according to the declaration.

When imposing penalties, the following options are possible:

- if the declaration is not submitted on time, but the VAT is paid to the budget in full and on time, then the taxpayer will have to pay 1000 rubles;

- In case of partial payment of the prescribed tax and late reporting, the fine will be calculated as 5% of the difference between the paid and accrued tax for each full month of delay.

Know: lack of business transactions in tax period does not exempt the taxpayer from filing a VAT return. For failure to submit a “zero” declaration on time, you will have to pay a fine of 1,000 rubles.

In addition to monetary penalties, the tax inspectorate has the right to punish an optional taxpayer in other ways:

- the head of the company (or individual entrepreneur) may be given an administrative penalty in the form of a fine in the amount of 300-500 rubles;

- If you are late in submitting your VAT return for more than 10 days, the taxpayer can count on blocking expenditure transactions on the current account.

A similar punishment (seizure of the current account) is provided for “simplified” taxpayers who are exempt from VAT, but are required to report as tax agents.

Remember: avoid penalties for late delivery VAT declaration is possible. To do this, it is advisable to send a “zero” report to the Federal Tax Service within the prescribed period, and subsequently submit an electronic adjustment of the declaration.

Late transfer to the budget of the tax calculated according to the declaration is fraught with the accrual of a penalty in the amount of 1/300 for each day of delay. The amount of the penalty is calculated by the tax authority, and a payment request for this amount is sent to the taxpayer’s bank.

Penalties and fines, as required by the tax inspectorate, are written off without acceptance, without the consent of the owner of the current account. Until the tax debt is paid in full, no debit transactions are made on the account.

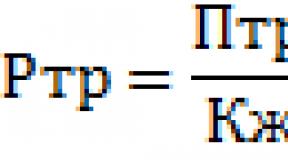

Deadlines for filing VAT returns in 2017year may vary depending on the specific type of reporting. Let's look at what determines the VAT reporting period.

When to submit a VAT return when selling goods and services in Russia?

The deadlines for filing the 2017 VAT return are set based on the legal relationship in which the individual entrepreneur or organization is involved.

The first type of VAT return is the one that is drawn up and submitted to the Federal Tax Service by organizations and individual entrepreneurs selling goods or services in Russia, as well as having the status of a tax agent - when importing goods and services from states not included in the EAEU association (including services - from all countries).

This declaration is drawn up in accordance with the form introduced by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558, and is submitted to the Federal Tax Service by the 25th day of the month following the reporting period. In this case - by quarter. In practice, this means that the following deadlines have been established for filing a VAT return in 2017:

- April 25, July 25, October 25 - according to reports for the 1st, 2nd and 3rd quarters, respectively;

- 01/25/2018 - for the 4th quarter.

All specified days are working days, and the established reporting deadlines cannot be postponed.

If the VAT payer did not have a taxable base in the reporting period, then he has the right to submit to the Federal Tax Service a zero declaration (in the specified form) or a single simplified declaration (however, the second type of declaration must be submitted earlier - before the 20th day of the month that is for the reporting period).

IMPORTANT! Any VAT returns are submitted to the Federal Tax Service only in electronic form via telecommunication channels.

Don't know your rights?

We have selected excellent electronic reporting services for you!

When to submit a VAT return when importing goods from the EAEU?

The second type of VAT return is the one approved by Order of the Ministry of Finance of the Russian Federation dated July 7, 2010 No. 69n. It is provided to the Federal Tax Service by individual entrepreneurs and organizations that imported any goods (but not services - when their importer is recognized as a tax agent) to Russia from the EAEU countries before the 20th day of the month following the month in which the imported goods were registered or in which the payment terms for the goods supplied under the contract come due.

Taking into account the postponement of the deadline for submitting the declaration, which falls on a weekend, to the next working day, filing a VAT return in 2017, within the framework of the legal relations under consideration, in practice is carried out:

- for December-March, May, June, August-November - until the 20th of the next month;

- for April - until May 22;

- for July - until August 21;

- for December - until 01/22/2018.

The deadlines for submitting the 2017 VAT return are determined based on the duration of the reporting period for a particular type of VAT. The legislation of the Russian Federation provides for 2 types of VAT declarations, and a separate reporting period is established for each of them.

Firstly, this is a standard declaration, according to which manufacturers of goods and service providers in Russia, importers of goods and services from foreign countries (including services from EAEU countries) report. Reporting period along it - a block. Secondly, this is a declaration filled out by importers of goods from the EAEU countries. The reporting period for it is a month.