Subsection 1.3 of the income tax return. An example of filling out an income tax return when paying dividends

The report is generated by tax agent enterprises when paying dividends or interest on securities to shareholders. If there are no specified calculations in the period, you do not need to fill out these pages. Let's consider what amounts are contributed to the section and in what order.

Sheet 03 of the income tax return - purpose

The indicated sheet must be filled out if there is data on income issued to legal entities based on the results equity participation or paid interest on securities (paragraph 4, clause 1.1 of the Procedure for filling). If settlements are made only with individuals, sheet 03 is not generated. This is due to the fact that on dividends to individuals, it is not the profit tax that is calculated and paid by tax agents, but the personal income tax. The normative procedure for taxation, withholding and payment of amounts to the budget is defined in stat. 275, paragraph 4, 5 art. 286, art. 284, paragraph 2, 4 art. 287, art. 310.1 Tax Code of the Russian Federation.

The main purpose of sheet 03 is to provide reliable information to the tax authorities on the listed dividends for a particular period. No data duplication required. That is, if the company distributed and paid out amounts for the 3rd quarter, the information is entered and presented in the calculation for the same quarter, the information is not re-submitted in the annual report (paragraph 2, clause 1, article 289 of the Tax Code of the Russian Federation).

Sheet 03 of the income tax return - procedure for filling out

The regulatory rules for filling out sheet 03 were approved by the Federal Tax Service by Order No. ММВ-7-3/572@ dated October 19, 2016 (Appendix XI). The current declaration form is also shown here. The sheet itself includes 3 sections:

- Sec. A – is intended for calculating tax amounts on dividends from participation in the activities of Russian enterprises. Information is provided by payment period.

- Sec. B – used to calculate tax amounts on interest income from securities (municipal and state).

- Sec. B - here is a breakdown of the recipients of dividend or interest payments. A separate section is formed for each recipient, provided that tax is charged on such payments.

An example of drawing up sheet 03 of a profit declaration

Let’s assume that based on the results of business activities for 2017, the company allocated 570,000 rubles for the payment of dividends. Of this, settlements with foreign enterprises not registered in the Russian Federation account for 370,000 rubles. (tax rate 0%); with Russian organizations – 200,000 rubles. (rate 13%).

The decision on payments was made in April. Accordingly, the data must be included in the calculation for the 2nd quarter of 2018. In other periods, these amounts do not need to be reflected.

When filling out section A, indicate the agent category code – 1; dividend type code – 2 (annual); period code – 21; year - 2018. On pages 001, 010 the total amount is given - 570,000 rubles; on lines 020, 022 – RUB 200,000.00; on line 040 – 370,000.00 rub. Further on page 090 – RUB 570,000.00. On page 100 the amount of tax calculated according to the formula is entered - 26,000 rubles. (200,000.00 x 13%).

Section B of sheet 03 is crossed out, since there were no interest payments. Section B contains information about the recipient of the income actually issued - a Russian enterprise on the amount of dividends from which tax was calculated and then paid to the state.

Sheet 03 of the income tax return is included in this report tax agent in case of payment of income to them in the form of dividends or interest on securities, issued by the state or municipality. Let's consider the features of using this sheet in the declaration.

Structure of sheet 03 of the profit declaration

The form of the current profit declaration form (approved by order of the Federal Tax Service of Russia dated October 19, 2016 No. ММВ-7-3/572@) requires the presence of sheet 03, intended to reflect the tax withheld by the tax agent from the income paid to him. Such income includes:

- dividends paid both on one’s own securities and on foreign ones, the issuer of which is not the reporting legal entity;

- interest accrued on state and municipal securities.

These two types of income determine the allocation of two sections devoted to them in sheet 3 of the profit declaration: A and B, respectively. But there is another section (B) in it, which reveals who exactly became the recipient of dividends or interest from which the tax agent withholds (or does not have the right to withhold) income tax.

Section A, dedicated to dividends, in comparison with section B, turns out to be quite voluminous and provides the following information:

- about the issuer of securities; in this case, the issuer’s TIN is provided only if dividends are accrued on securities other than its own;

- about the nature of accruals: interim, carried out at the end of the reporting period or final (for the year);

- on the total amount of dividends paid and their distribution between the main groups of recipients (Russian and foreign organizations, Russian and foreign individuals, persons not considered recipients of income in the form of dividends), and in relation to Russian legal entities and foreign individuals, the amounts are detailed at the rates applied to them ;

- on the calculation of tax withheld from income paid to Russian legal entities, indicating the indicators involved in such calculation (the amount of dividends received by the reporting entity itself and the tax rates used in the calculation).

Section A will need to be completed separately for each issuer.

The number of sections B in the report will be determined by the tax rate applied to the interest paid. This section is easy to fill out: tax base, rate, tax amount.

What Sections A and B have in common is the presence of lines in them that allow you to see separately the amounts of tax accrued for the last period of the year included in the declaration and for the periods preceding it.

What determines the frequency of inclusion of sheet 03 in the report?

Filling out sheet 3 in the profit declaration becomes mandatory when the reporting legal entity becomes liable as a tax agent in relation to income tax (clause 1.1 of Appendix No. 2 to Order No. ММВ-7-3/572@). Moreover, this obligation also applies to organizations that are not payers of income tax (clause 1.7 of Appendix No. 2 to Order No. MMV-7-3/572@).

The inclusion of sheet 03 in the declaration occurs in the reporting period when grounds for this appear, i.e. when the corresponding income is paid. Such a reporting period, depending on what frequency (quarterly or monthly) the organization has chosen for paying advances, may be the period ending with the end of the next quarter or month (clause 1.3 of Appendix No. 2 to Order No. ММВ-7-3/572@ ).

Since the declaration is drawn up on an accrual basis, data included in sheet 03 in a time period that is not the last for the tax period will be reflected in this sheet (duplicating or supplementing) until annual reporting. When preparing sections A and B, this will require control over the correct linking of data on the tax accrued for the reporting period: in the lines reserved for information about accruals for the last period included in the report, or in lines referring to periods preceding current period report.

Nuances of filling out sheet 03

When filling out sheet 03, it is important to keep the following in mind:

- How many sheets 03 there will be in the report determines the number of decisions on payments (clause 11.2.1 of Appendix No. 2 to Order No. MMV-7-3/572@).

- Sections A and B contain summary information on income paid, and payments may be made on different days. Details of payments by date are given in subsection 1.3 of section 1 of the declaration. That is, subsection 1.3, if there is data in sections A and (or) B on income on which income tax is paid, will have to be filled out, while for information that falls into sections A and B, it is formed separately. The dates in subsection 1.3 will indicate the deadlines for paying the tax withheld from income to the budget. Let us remind you that you must pay tax on income in the form of dividends and interest no later than the working day following the day it was withheld from the paid income (clause 4 of Article 287 of the Tax Code of the Russian Federation).

- Section B is not always filled out, since it is intended for information only about Russian legal entities - recipients of income who must pay income tax on it. That is, if all income is paid to persons who are not payers of this tax (foreign organizations, individuals - both foreign and Russian) or Russian legal entities through which the income is paid to its actual recipient), then section B does not need to be filled out. In the latter case (when paying to a legal entity that will subsequently perform the functions of a tax agent), it becomes optional to include Sheet 03 itself in the declaration (clause 1.7 of Appendix No. 2 to Order No. ММВ-7-3/572@).

- The fact of non-withholding of tax (when paid to a legal entity that will subsequently perform the functions of a tax agent) in section B is recorded by adding the words “tax agent” to the name of the income recipient (clause 11.4 of Appendix No. 2 to Order No. ММВ-7-3/572@).

- Income distributed to individuals only does not exempt from drawing up sheet 03 (clause 1.7 of Appendix No. 2 to Order No. ММВ-7-3/572@). Decoding information about such income recipients in the profit declaration is also provided. However, it is done only once (at the end of the year) and is given in a special appendix (No. 2) to the declaration (clause 1.8 of appendix No. 2 to order No. ММВ-7-3/572@).

The quality of the person reporting with the inclusion of sheet 03 in the declaration is reflected in the form of the code of the place of submission of the report indicated on its title page: 213 or 214 - for the largest and ordinary taxpayers, 231 or 235 - for tax agents who do not report on income tax.

Results

Sheet 03 is drawn up in the profit declaration in case of payment of income on securities. It contains 3 sections intended for data on dividend payments (section A), interest on securities issued by the state or municipality (section B), and information about Russian legal entities receiving such income (section B). Sheet 03 is filled out during the period of income payments, and it is kept in the declaration until the end of the year. Depending on who the income is paid to, when filling out sections of sheet 03, a number of nuances should be taken into account.

In Section A "Calculation of income tax on income in the form of dividends (income from equity participation in other organizations established on the territory of the Russian Federation)" when interim payment of dividends according to the "Type of dividends" detail, code "1" is indicated, when paying dividends based on results fiscal year - code "2". The “Tax (reporting) period” detail indicates the code of the period for which dividends are distributed. The codes defining the reporting (tax) periods are given in Appendix No. 1 to this Procedure. The “Reporting year” requisite indicates the specific year for the reporting (tax) periods of which dividends are paid.

Line 010 indicates the amount of dividends to be distributed among shareholders (participants) by decision of the meeting of shareholders (participants), including the amount of dividends payable to organizations that pay income tax, payment to shareholders (participants) who are not payers of income tax, in particular, to mutual investment funds that are not legal entities, constituent entities of the Russian Federation and other public legal entities, payments to individuals who are residents of the Russian Federation, foreign organizations and individuals who are not residents of the Russian Federation.

Lines 020 and 030 reflect the amounts of dividends accrued to foreign organizations and individuals who are not residents of the Russian Federation, who do not participate in the calculation of income tax in the manner established by paragraph 2 of Article 275 of the Code.

Lines 031 - 034 indicate the amounts of dividends accrued to foreign organizations and individuals who are not residents of the Russian Federation, taxes on which are subject to withholding in accordance with international treaties of the Russian Federation on tax rates below that established by subparagraph 3 of paragraph 3 of Article 284 of the Code.

Line 040 reflects the amounts of dividends subject to distribution to Russian shareholders (participants): Russian organizations - profit tax payers, organizations that are not profit tax payers, and individuals who are residents of the Russian Federation.

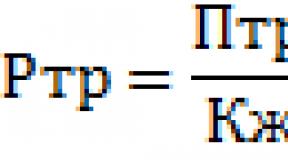

The indicator in line 040 corresponds to the indicator “d” and the denominator of the indicator “K” in the formula for calculating the tax subject to withholding by the tax agent from the income of the taxpayer - recipient of dividends, given in paragraph 2 of Article 275 of the Code.

Line 041 reflects the amounts of dividends subject to distribution to Russian organizations - profit tax payers specified in subparagraph 2 of paragraph 3 of Article 284 of the Code.

Line 042 reflects the amounts of dividends subject to distribution to Russian organizations - profit tax payers specified in subparagraph 1 of paragraph 3 of Article 284 of the Code.

The indicators of lines 041 - 042 include the amount of dividends subject to distribution to organizations that have switched to a simplified taxation system (subparagraph 2 of paragraph 1.1 of Article 346.15 of the Code), for the payment of a single tax on imputed income for certain types of activities (paragraph 4 of Article 346.26 of the Code) applying the system taxation for agricultural producers (unified agricultural tax) (clause 3 of Article 346.1 of the Code).

Line 043 reflects the amounts of dividends subject to distribution in favor of individuals - residents of the Russian Federation, upon payment of dividends to which personal income tax is calculated, subject to withholding by the tax agent in accordance with Article 214 of the Code and paragraph 2 of Article 275 of the Code.

Line 044 indicates dividends subject to distribution in favor of persons who are not income tax payers, in particular dividends on shares owned by the Russian Federation, constituent entities of the Russian Federation or municipalities, dividends on shares constituting the property of mutual investment funds.

Lines 070 and 071 reflect the amounts of dividends received by the tax agent himself from Russian and foreign organizations, minus the income tax withheld from these dividend amounts by the source of payment (tax agent).

In this case, line 070 reflects the amount of dividends received by the tax agent itself after the date of distribution of dividends between shareholders (participants) in the previous tax period, as well as from the beginning of the current tax period until the date of distribution of dividends between shareholders (participants) for the period specified in Section A Sheet 03. Thus, line 070 should reflect amounts that were not previously taken into account when determining tax base determined in relation to income received by the tax agent in the form of dividends.

From the amount of dividends indicated on line 070, line 071 reflects the amount of dividends received by the tax agent himself, with the exception of dividends specified in subparagraph 1 of paragraph 3 of Article 284 of the Code, the tax on which is calculated at a rate of 0 percent.

The indicator in line 071 corresponds to indicator “D” in the tax calculation formula given in paragraph 2 of Article 275 of the Code.

The amount of dividends on line 090, used to calculate tax, is calculated by subtracting the indicator on line 040 from line 040.

The indicator in line 090 corresponds to the difference between indicators “d” and “D” in the tax calculation formula given in paragraph 2 of Article 275 of the Code. If the indicator on line 090 has a negative value, then the obligation to pay tax does not arise and compensation from the budget is not made, and dashes are placed on lines 091 - 120.

The indicator of line 090 may differ from the sum of the indicators of lines 091 and 092 by the amount of dividends on which the income tax of individuals who are residents of the Russian Federation is calculated, and the amount of dividends in favor of shareholders (participants) who are not income tax payers.

Line 091 reflects the amount of dividends, the profit tax on which is calculated to be withheld from Russian organizations specified in subparagraph 2 of paragraph 3 of Article 284 of the Code at a rate of 9 percent. The indicator is defined as the sum of data on the size of the tax bases for each specified taxpayer, calculated using the formula for calculating the amount of tax given in paragraph 2 of Article 275 of the Code without applying the tax rate.

Line 092 reflects the amount of dividends, the profit tax on which is calculated to be withheld from Russian organizations specified in subparagraph 1 of paragraph 3 of Article 284 of the Code at a rate of 0 percent. The indicator is defined as the sum of data on the size of the tax bases for each specified taxpayer, calculated using the formula for calculating the amount of tax given in paragraph 2 of Article 275 of the Code without applying the tax rate.

Line 100 reflects the calculated amount of income tax, equal to the total amount of tax calculated for each taxpayer - a Russian organization specified in subparagraph 2 of paragraph 3 of Article 284 of the Code.

Line 110 reflects the amount of income tax calculated on dividends paid in previous reporting (tax) periods in relation to each decision on the distribution of income from equity participation.

Line 120 reflects the amount of income tax accrued on dividends paid in the last quarter (month) of the reporting (tax) period in relation to each decision on the distribution of income from equity participation.

When dividends are paid partially (in several stages), the payment of income tax is reflected on lines 040 of subsection 1.3 of Section 1 of the Declaration. In this case, the period is indicated by the taxpayer based on the date of payment of dividends in accordance with paragraph 4 of Article 287 of the Code.

From this consultation you will learn who and in what cases is obliged to fill out Sheet 03 of the income tax return, as well as on what principle it is filled out.

Structure of Sheet 03

The current form of the company income tax declaration is established by order of the Federal Tax Service of Russia dated October 19, 2016 No. ММВ-7-3/572. According to it, Sheet 03 of the income tax return in 2018 is intended to calculate the income tax that the company must withhold as a tax agent and source of payment. The same order established the rules for filling out the income and profit declaration (hereinafter referred to as the Procedure).

Who should fill out Sheet 03 of the income tax return becomes clear from the three sections it includes:

As you can see, dividends to individuals are also reflected in Sheet 03 of the income tax return (in lines 020, 021, 022, 023, 024, 030, 040, 050, 051, 052, 053, 054, 060). That is, it shows not only receipts addressed to legal entity in general, but also the dividends that this company accrued to individuals and legal entities, and submits this report as a tax agent.

Who is obliged to include Sheet 03 in the declaration

Now about who fills out Sheet 03 of the income tax return. In relation to Section A this is:

- companies - issuers of securities (i.e., distributing the remaining profit after payment of tax) and recognized in this regard as tax agents on the basis of clause 3 and sub. 1, 3 p. 7 art. 275 Tax Code of the Russian Federation;

- companies are not issuers of securities, but pay income on them (must indicate the issuer's TIN) and are recognized in this regard as tax agents on the basis of sub-clause. 2, 4, 5, 6 clauses 7 and 8 art. 275 Tax Code of the Russian Federation.

In turn, Section B is intended for those organizations that pay interest on state and municipal securities. The tax on them may be:

- 15% (subclause 1, clause 4, article 284 of the Tax Code of the Russian Federation);

- 9% (subclause 2, clause 4, article 284 of the Tax Code of the Russian Federation).

Rules for filling out Sheet 03

One of the basic principles for filling out Sheet 03 of the income tax return is on an accrual basis. Since the profit from dividends and/or shares in other businesses, the company shows:

- for the reporting period – 1st quarter, half a year and 9 months;

- then for the whole taxable period– calendar year.

Sometimes the question arises: is it necessary to fill out Sheet 03 of the income tax return several times if there were several decisions on the payment of dividends during the year? Yes, this is necessary: one such decision is a separate Sheet 03 filled out for it (clause 11.2.1 of the Procedure).

In general, you need to show information about dividends:

1. In Section A and B of Sheet 03.

2. Subsection 1.3 of Section 1 of Sheet 01.

Section B of Sheet 03 is filled out for each organization to which the dividends shown in Section A of Sheet 03 were accrued. Including those taxed at a zero rate.

Sample filling

Let’s assume that Guru LLC submits income tax returns every quarter. In 2017, this company received dividends in the amount of 8 million rubles. Among them:

- taxed at a zero rate – 2 million rubles;

- taxed at a rate of 13% - 6 million rubles.

These dividends were not taken into account when calculating the tax on dividends paid by Guru LLC in 2017.

The participants decided to distribute profits for 2017 in the amount of 11 million rubles. Dividends were paid on March 22, 2018, and the tax withheld from them was transferred to the treasury on March 23, 2018.

From the total amount of dividends:

- 2 million rubles - accrued to its individual participant;

- 9 million rubles – to participants-legal entities.

The table below shows the main indicators of income tax on dividends issued to organizations.

Since the dividends were paid based on only one decision of the owners, Guru LLC will include one Sheet 03 in the declaration for the first quarter of 2018, in which it will fill out:

- one Section A;

- three Sections B (for each company receiving dividends).

In addition, Guru LLC will include subsection 1.3 of Section 1 of Sheet 01 in the report.

As a result, you need to fill out the declaration as follows:

In the report for half a year, 9 months and the whole of 2018, in lines 01 to 21, as well as in all lines 040 of subsection 1.3 of Section 1 of Sheet 01, dashes are placed for these dividends.

In the report for half a year, 9 months and the whole of 2018, Section A of sheet 03 for these dividends is drawn up in the same way as in the declaration for the 1st quarter. Except lines 110 and 120:

Tax liability for late submission of declarations is established in Article 119 Tax Code RF. From January 1, 2014, the category “taxpayer” was excluded from the text of this article (clause 13 of article 10 of the Law of June 28, 2013 No. 134-FZ). Therefore, at present, the tax inspectorate can fine for such an offense any organization that must submit income tax reports, but for any reason has not fulfilled this obligation. Including the tax agent.

Composition of reporting

The income tax calculation prepared by the tax agent includes:

This is stated in paragraphs 1.7 and 1.8 of the Procedure approved by order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600.

Depending on who the recipient of the dividends is (an organization or an individual), the sections that need to be filled out may be different.

| Recipients of dividends | What sheets (sections) need to be filled out? |

|||

|---|---|---|---|---|

| Organizations on OSNO | Organizations on special regime |

|||

| JSC | OOO | JSC | OOO |

|

| Individuals and organizations | Sheet 03; Subsection 1.3 of section 1; | Included in the declaration: Sheet 03; Subsection 1.3 of section 1 (by organization). | The calculation is submitted as follows: Title page; Sheet 03; Subsection 1.3 section 1; | The calculation is submitted as follows: Title page; Sheet 03; Subsection 1.3 of section 1 (by organization). |

| Organizations only | Included in the declaration: Sheet 03; Subsection 1.3 section 1 | The calculation is submitted as follows: Title page; Sheet 03; Subsection 1.3 section 1 |

||

| Only individuals | Included in the declaration: Sheet 03; Subsection 1.3 of section 1; Appendix 2 (for each individual shareholder) | The calculation for tax agents is not included in the declaration. | The calculation is submitted as follows: Title page; Sheet 03; Subsection 1.3 section 1; Appendix 2 (for each individual shareholder) | The calculation is not submitted. |

| Only foreign organizations | Included in the declaration: Sheet 03; Subsection 1.3 section 1 | The calculation is submitted as follows: Title page; Sheet 03; Subsection 1.3 section 1 |

||

| Submit a tax calculation (information), the form of which was approved by order of the Ministry of Taxes of Russia of April 14, 2004 No. SAE-3-23/286 |

||||

Important: subsection 1.3 must be included in the declaration even if dividends were paid only to foreign organizations. This follows from the literal content of paragraphs 1, 2 and 6 of clause 1.7 of the Procedure, approved by order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600. In fact, this subsection will be empty (with dashes). In this case, the amount of tax on dividends paid to foreign organizations must be reflected in the tax calculation (information), the form of which was approved by order of the Ministry of Taxes of Russia of April 14, 2004 No. SAE-3-23/286.

Situation: as an organization that uses common system taxation, report on income tax paid to the budget as a tax agent - separately or as part of the general tax return?

If the organization is a payer of income tax, include a tax calculation of the amounts of withheld tax as part of the general declaration.

In this case, on the title page, according to the details “at the location (registration)”, indicate code 213 (“at the place of registration as the largest taxpayer”) or 214 (“at the location of the Russian organization that is not the largest taxpayer”). Code 231 (“at the location of the tax agent - organization”) on the title page indicates only organizations that are not payers of income tax (for example, those using special tax regime ).

This follows from paragraph 1.7 of the Procedure, approved by order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600.

Filling out the calculation

Fill out the calculation in rubles, without kopecks. Correction of calculation errors by means of a correction or other similar means is not permitted. If there are no indicators to fill out, then put dashes in the corresponding lines and columns. Enter negative numerical values with a minus sign in the first cell on the left. Fill in the text indicator fields in block letters from left to right. For example, when filling out cells with the name of the organization on the title page, starting from the left, indicate this detail in block letters (there is no need to put dashes in the remaining cells).

After the calculation is completed, number all pages sequentially.

Such rules are provided for in section II of the Procedure, approved by order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600.

For more information on filing tax returns, see How to prepare tax returns .

Filling out the title page

On the title page please indicate:

- TIN and KPP of the organization (fill out the cells allocated for the TIN from left to right, starting from the first cell);

- adjustment number (for the initial calculation “0--”, when submitting an updated calculation the adjustment number “1--” (“2--”, etc.) is indicated);

- tax (reporting) period code in accordance with Appendix 1 to the Procedure approved by order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600.

The title page must contain the date the reports were completed, as well as the signature of the person certifying the accuracy and completeness of the information specified in the calculation.

Such rules are provided for in section III of the Procedure, approved by order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600.

Filling out sheet 03

To reflect the transactions of tax agents in the calculation of income tax, sheet 03 “Calculation of corporate income tax withheld by the tax agent (source of income payment)” is provided.

Sheet 03 is filled out only based on the results of those periods in which the organization transferred dividends. There is no need to duplicate data in subsequent calculations. For example, if both the decision to distribute dividends and their actual payment took place in the first quarter, then the tax agent’s obligations to withhold income tax from the amount of accrued dividends arise for the organization in the first quarter. Therefore, the tax calculation is reflected in sheet 03, which must be included in the calculation compiled based on the results of the first quarter. If no other decisions on the distribution of dividends were made during the year and no payments were made, then repeat this calculation in the declarations for other reporting periods and for the year as a whole it is not necessary. This follows from the provisions of paragraph 2 of paragraph 1 of Article 289 of the Tax Code of the Russian Federation, paragraphs 1.1, 1.7 and 11.1 of the Procedure approved by order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600.

Fill out Sheet 03 both when paying dividends to organizations and individuals, and when paying dividends only to individuals. It should be noted that if the participants of the LLC are only individuals, when paying dividends to them, they must submit an income tax return . This follows from paragraph 6 of paragraph 1.7 and paragraph 11.2.2 of the Procedure approved by order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600.

Explanations on the procedure for filling out the lines of sheet 03 (using a numerical example of calculating tax on income in the form of dividends) are given in the letter of the Federal Tax Service of Russia dated June 10, 2010 No. ШС-37-3/3881. Since the procedure for calculating tax has not fundamentally changed, this letter can still be used as a guide today.

Situation: what indicators should be reflected in the calculation of income tax to a tax agent paying income to a foreign organization (dividends, as well as other income, except interest on state and municipal securities)?

If a tax agent pays income to a foreign organization, in the calculation of income tax, the form of which was approved by order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600, you only need to fill out line 040 of section A of sheet 03. For this line, indicate the amount of dividends accrued in favor of all foreign organizations. The amount of tax on these dividends is not reflected in the calculation. It must be taken into account when filling out a tax calculation (information) on the amounts of income paid to foreign organizations and taxes withheld, the form of which was approved by order of the Ministry of Taxes of Russia of April 14, 2004 No. SAE-3-23/286.

Other income paid by a tax agent to foreign organizations that do not have a permanent establishment in Russia is reflected only in the tax calculation (information) on the amounts of income paid to foreign organizations and taxes withheld. For calculations, seeHow to draw up and submit calculations (information) on income paid to foreign organizations .

Completing subsection 1.3 of section 1

Subsection 1.3 of Section 1 of the declaration is intended to reflect the amount of income tax on dividends (interest) that the organization pays in the last quarter of the current reporting (tax) period.

In subsection 1.3 of section 1 you need to indicate:

- on line 010 - type of payment (code);

- on line 020 - OKTMO codes according to the All-Russian Classifier, approved by order of Rosstandart dated June 14, 2013 No. 159-st;

- on line 030 - KBK for income tax, depending on the tax rate.

Fill in the cells containing the OKTMO code from left to right. If the OKTMO code contains less than 11 characters, put dashes in the cells left empty. This is stated in paragraph 7 of clause 4.1 of the Procedure approved by order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600.

If an organization withholds income tax on both dividends and interest on state and municipal securities, subsection 1.3 must be completed separately for each type of income paid.

If an organization withholds income tax on dividends (payment code 01), the sum of the indicators in line 040 of subsection 1.3 must correspond to the indicator in line 120 of section A of sheet 03. If the number of dividend payment terms exceeds the number of corresponding lines of subsection 1.3 of section 1 of the declaration, this subsection must be completed on several pages.

If an organization pays income tax on interest (payment code 2), the sum of the indicators in lines 040 must correspond to the indicator in line 050 of section B of sheet 03 of the declaration.

This follows from paragraphs 4.4.1, 4.4.2 of the Procedure approved by order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600.

Appendix 2 to the declaration

Appendix 2 to the declaration is filled out by tax agents who pay citizens income from transactions with securities, financial instruments of futures transactions, as well as income from securities of Russian issuers. That is, organizations that are recognized as tax agents for personal income tax in accordance with Article 226.1 of the Tax Code of the Russian Federation. In particular, when paying dividends on shares, Appendix 2 - these payments fall under the definition of “income on securities of Russian issuers.”

If an organization is not required to submit an income tax return, but it is a tax agent in accordance with Article 226.1 of the Tax Code of the Russian Federation, it is necessary to submit an income tax calculation in the minimum composition:

- title page;

- Appendix 2 to the declaration.

This is stated in paragraph 1.8 of the Procedure approved by order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600.

The application must be filled out when paying income on securities of Russian issuers, as well as income:

- on transactions with securities;

- on operations with financial instruments of futures transactions;

- on REPO transactions with securities;

- on securities lending transactions.

The application must reflect information about the citizen, the amount of income and taxes withheld from income, as well as other similar information. Appendix 2 must be drawn up for each citizen to whom income was paid. This follows from paragraphs 17.1-17.6 of the Procedure approved by order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600.

If information about income paid to individuals is reflected in Appendix 2 to the income tax return, then duplicate this information in the certificatesform 2-NDFL no need. This was stated in the letter of the Ministry of Finance of Russia dated January 29, 2015 No. 03-04-07/3263 (brought to the tax inspectorates for use in their work by letter of the Federal Tax Service of Russia dated February 2, 2015 No. BS-4-11/1443 and posted on official website tax service in the section “Explanations of the Federal Tax Service of Russia, mandatory for application”).

An example of filling out an income tax calculation by a tax agent

Alpha LLC uses simplification. The authorized capital of the organization includes:

- Russian organization LLC Trading Company Hermes (20%);

- individual - Alexander Vladimirovich Lvov (80%).

In March 2016, Alpha accrued and paid dividends for 2015 in the total amount of 200,000 rubles. Dividends are distributed as follows:

- LLC "Trading Company "Hermes"" - 40,000 rubles. (RUB 200,000 × 20%);

- A.V. Lviv - 160,000 rub. (RUB 200,000 × 80%).

According to subparagraph 2 of paragraph 3 of Article 284 of the Tax Code of the Russian Federation, dividend payments to Russian organizations are subject to income tax at a rate of 13 percent. Acting as a tax agent, the Alpha accountant calculated and transferred to the budget the income tax on Hermes dividends. The tax amount is 5200 rubles. (RUB 40,000 × 13%). Dividends paid to Lvov are not subject to income tax.

On April 28, 2016, Alpha submitted to the tax office an income tax return consisting of the following sections:

- title page indicating the code by location (place of registration) - 231;

- subsection 1.3 of section 1, compiled by type of payment 1, which reflects the amount of income tax on income in the form of dividends and the timing of their transfer;

- Sheet 03, which reflects the total amount of dividends paid, its distribution among the founders, and also provides information about the organization receiving the dividends.

Since the declaration form does not imply the reflection of dividends taxed at a rate of 13 percent, the accountant was guided by the letter of the Federal Tax Service of Russia dated February 26, 2015 No. GD-4-3/2964 and indicated this amount on line 091 of section A of sheet 03.

Appendix 2 to the declaration “Alpha” is not submitted. Despite the fact that she is a tax agent, dividends from LLC participants are not listed in Article 226.1 of the Tax Code of the Russian Federation (clause 17.1 of the order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600).

Situation: How to reflect in the income tax return dividends accrued to an LLC participant - an individual (resident)? The participant has assigned the right to receive dividends to a third party.

Fill out the declaration in . The fact that an LLC participant refused dividends in favor of a third party does not matter.

Generating income

If a participant has instructed to transfer the dividends due to him to a third-party organization, this does not mean that he did not receive taxable income. In the situation under consideration, he disposed of this income. That is, he first recognized his right to dividends, and then ceded it to a third party. Therefore, the amount of dividends must be included in the calculation of the tax base for personal income tax. This is directly stated in paragraph 1 of Article 210 of the Tax Code of the Russian Federation.

The date of actual receipt of income will be the date when the dividends were transferred to the account of a third party by order of the participant (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation). Personal income tax must be withheld from the amount of dividends (clause 4 of article 226 of the Tax Code of the Russian Federation).

Tax reporting

Reflect the total amount of dividends for distribution in line 001 of sheet 03 (section A) of the income tax return. Please take into account dividends accrued to an individual participant (resident) when filling out lines 030 and 090 of sheet 03 (section A). Do not include these dividends in the calculation of other tax return indicators.

Appendix 2 to the declaration for this participant . Please indicate information about dividends in the certificate form 2-NDFL, approved by order of the Federal Tax Service of Russia dated October 30, 2015 No. ММВ-7-11/485.

This follows from the provisions of paragraphs 1.7, 1.8 and 11.2.2 of the Procedure, approved by order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600.

It should be noted that if the participants of the LLC are only individuals, when paying dividends to them, they must submit an income tax return .