Depreciation of a group of fixed assets. Useful life of fixed assets

The government approved new Classification of fixed assets, by which it is necessary to determine the depreciation period in tax accounting

(Resolution of the Government of the Russian Federation of July 7, 2016 No. 640).

Federal Tax Service specialists report that from January 1, 2017 companies will determine depreciation periods in tax accounting based on on the new classifier of fixed assets included. Amendments to the current OS classification were made by Decree of the Government of the Russian Federation dated July 7, 2016 No. 640 and were due to the transition to new classifier OKOF(All-Russian Classifier of Fixed Assets).

Reference:

Current OKOF - OK 013-94.

New (from 01/01/2017) OKOF - OK 013-2014 (SNA 2008).

The Federal Tax Service notes that amendments to the “depreciation” classification of fixed assets changed not only the codes, but also the composition of a number of depreciation groups. However, such changes do not oblige recalculate the depreciation rate if, according to the new classification, the fixed asset is in a different depreciation group and its term has changed beneficial use. For already introduced objects, the deadlines remain the same. At the same time, for operating systems that will be put into operation from January 1, 2017, it will be necessary to focus on the new service life, as noted in the information message on the website of the Federal Tax Service of the Russian Federation. The message also notes that in the OS-6 inventory cards there is no need to correct old OKOF codes with new ones.

How to switch from old codes to new ones

ROSSTANDART approved direct and reverse transitional keys between the editions of OK 013-94 and OK 013-2014 (SNS 2008) of the All-Russian Classifier of Fixed Assets (OKOF). Straight adapter key- this is a table that shows the codes and names of positions of the old and new classifiers. In this case, each position of the old classifier corresponds to one or more positions of the new classifier. Reverse adapter key from the new classifier to the old one is also presented in the form of a table. It contains codes and names of positions of the new and old classifiers. In the transition key, each position of the new classifier corresponds to one or more positions of the old classifier. The transition key states, which codes of the current OKOF correspond to the codes that will be used from 2017, and for which new codes there are no correspondences.Links to OKOF documents:

1. Source - ConsultantPlus:2. Source -

- ALL-RUSSIAN CLASSIFIER OF FIXED ASSETS OK 013-2014 (SNA 2008)

- Straight

transition key from OKOF OK 013-94 to OKOF OK 013-2014 (SNS 2008)- Back

transition key from OKOF OK 013-2014 (SNS 2008) to OKOF OK 013-94

All fixed assets, without exception, depending on which depreciation group they belong to, have a useful life. Installed Classifier allows to fully define depreciation group object, as well as the intended service life.

Table of fixed assets

Used updated version of the fixed assets table.

| Group serial number | What is included in the group of fixed assets | What is the period of use |

|---|---|---|

| 1 | The group includes all assets, and their useful life is short. | No more than 2 years |

| 2 | Everything except vehicles and other equipment. In addition, the group includes durable plantings. | No more than 36 months |

| 3 | This group includes not only structures, but also vehicles. | No more than 5 years |

| 4 | Contains non-residential real estate and various draft animals. | No more than 7 years |

| 5 | Contains transmission equipment, vehicles and various structures. | No more than 10 years |

| 6 | Residential property and a variety of perennial seedlings. | No more than 15 years |

| 7 | Fixed assets that have not yet appeared in other groups. | No more than 20 years |

| 8 | Numerous structures (of various types) and a variety of vehicles. | Up to 25 years |

| 9 | Various structures, transmission equipment, vehicles. | No more than 30 years old |

| 10 | A variety of equipment, various seedlings, vehicles and so on. | More than 30 years |

In order to find out exactly which group the main asset belongs to, it will be enough to use the classifier table.

In order to find out exactly which group the main asset belongs to, it will be enough to use the classifier table.

It is worth paying attention to the fact that companies are given the opportunity to find out on their own information regarding which group a particular OS belongs to.

In the event that the required object is not in the classifier, the period of application of the OS can be found out based on the manufacturer’s recommendations or available technical documentation.

How can you find out the SPI for objects that have already been in operation? In the process of acquiring those objects that were previously in use by their companies, some difficulties may arise in the process of calculating the period under consideration.

To facilitate the necessary calculations, it will be enough to use one of several options, namely:

- the time period is formed according to the accepted Classifier, but it must be reduced by the operational period by the previous owner;

- the time period that was formed by the previous owner must be reduced by the actual period of application.

Using one of these methods, you can easily determine the period of useful use of used equipment.

According to Article 258 of the Tax Code of the Russian Federation, the company's fixed assets, depending on the period of useful use of a particular property directly for income tax purposes, can be assigned to one of the established groups.

According to Article 258 of the Tax Code of the Russian Federation, the company's fixed assets, depending on the period of useful use of a particular property directly for income tax purposes, can be assigned to one of the established groups.

Concerning period of useful use of the PF, then the company is obliged to calculate it on its own with the obligatory consideration of a specially developed Classification, which was approved by the Decree of the Government of the Russian Federation.

For 2019, Government Decree No. 640 is in force. Also valid All-Russian classifier of OS (abbreviated version OKOF). In parallel with this, the previous OKOF OK 013-94 was canceled.

For this reason, the OS Classifier is also subject to modification. Moreover, on the basis of the Order of Rosstandart, direct and transitional keys were adopted.

Determination of useful life includes several stages, namely:

- Definition of the OS group relative to the Classification, which was approved by the Decree of the Government of the Russian Federation in accordance with paragraph 4 of Article 258 of the Tax Code of the Russian Federation.

- In the event that the OS is not in the Classification and OKOF, then it is necessary to determine the period based on the operational life (based on paragraph 6 of Article 258 Tax Code RF).

- The period that has been established must be recorded in the so-called asset inventory card (drawn up in the form). In a situation where the tax and accounting periods differ from each other, then in the second section of the form it will be necessary to add the corresponding column.

In the process of following these steps, determining the useful life period will not be difficult. It is enough just to adhere to a clear sequence of actions and avoid various types of mistakes.

Let's consider the calculation using a specific example: the company bought a Gazelle cargo vehicle, which has a carrying capacity of 1.5 tons. We will determine the period of its useful use, taking into account all the available nuances.

Let's consider the calculation using a specific example: the company bought a Gazelle cargo vehicle, which has a carrying capacity of 1.5 tons. We will determine the period of its useful use, taking into account all the available nuances.

According to the approved OS Classifier, general use freight vehicles with a specified carrying capacity within 0.5-5 tons belong to the fourth group.

Based on this, the SPI for the fourth group varies within from 5 to 7 years inclusive. Thus, the minimum useful life in months is:

5 years * 12 calendar months + 1 month = 61 months

As for the maximum period, it is:

7 years * 12 calendar months = 84 months

It should be noted that companies have the full legal right to independently establish the useful life of vehicles within from 61 to 84 months.

Change

Based on the generally accepted rule, the useful life period is subject to revision if the fact of a significant improvement in the initial established standard values of the object based on the results is confirmed (based on paragraph 1 of Article 258 of the Tax Code of the Russian Federation):

- completed completion;

- completed reconstruction;

- carried out modernization.

Attention must be paid to the fact that for the purposes of immediate tax accounting, an increase in the useful life period can only be carried out within the time frame established exclusively for the specific group that includes a specific product.

To significantly facilitate the transition to the new established OKOF, so-called special compliance keys were generated. By keys we mean the names of not only subgroups, but also the groups themselves.

To significantly facilitate the transition to the new established OKOF, so-called special compliance keys were generated. By keys we mean the names of not only subgroups, but also the groups themselves.

In the process of working with the keys in question, it is necessary to pay attention to such nuances, How:

- For developed forward jump tables it was accepted that the old indicator corresponded to the new one (and one or more). If the exact name of the objects is not in the list, then it is necessary to take into account the most suitable name.

- For generated reverse transition tables it was accepted that the new indicator corresponded to the old one (also for one or several).

It is necessary to additionally pay attention to the prescribed procedure for the transition process, which consists in next:

- Using transitional keys, clearly define the new code of a specific fixed asset object.

- Display all necessary information regarding the new code in the existing inventory record card of the object. It is imperative to make a certain note indicating that the new code has taken effect. Moreover, it is important to remember that there is no need to requalify the OS, since it is enough to just indicate their new code indicators. In other words, only property that is directly related to .

- It is necessary to create a new group for the OS (this must be done exclusively in relation to those objects that have been put into operation). This means that there is no need for old OS objects to modify their useful life. If a suitable code is not available, then it is imperative to take into account the indicator of the highest level.

Provided that the prescribed algorithm is followed, the necessary transition can be carried out without any special difficulties. It is enough just to avoid various kinds of errors or typos, since otherwise you may receive unreliable information.

Application

According to the generally accepted rule, the period under review is subject to revision at the moment when there was a significant improvement in the initially established values of the functioning of a particular facility as a result of completion, modernization, reconstruction or additional equipment.

It is worth recalling that in tax accounting, an increase in the period under review can be carried out exclusively within the framework of the period that was established directly for the group of fixed assets where the funds were previously entered.

In this situation, if the period under consideration upon completion of reconstruction, modernization or technical re-equipment has been increased, then the company has a unique opportunity to calculate depreciation at the rate that is calculated on the basis of the new adopted useful life period of the fixed asset (based on the Letter of the Ministry of Finance of Russia) .

In this situation, if the period under consideration upon completion of reconstruction, modernization or technical re-equipment has been increased, then the company has a unique opportunity to calculate depreciation at the rate that is calculated on the basis of the new adopted useful life period of the fixed asset (based on the Letter of the Ministry of Finance of Russia) .

However, such a recalculation of the norm may lead to the fact that a particular object will take longer to depreciate. For this reason, for a company in such a situation, the most optimal solution would be to implement according to the old standards.

If, upon completion of the modernization/reconstruction, the initial cost of the object has changed, but the period under consideration remains at the same level, then the depreciation rate in the process of applying the directly linear option in tax accounting will be impossible to revise, and for the period of completion of the considered SPI, the fixed asset will not be depreciated at to the fullest.

In parallel with this, according to the available clarifications of the Ministry of Finance of the Russian Federation, companies in such a situation are allowed to continue calculating depreciation in a linear way until the full repayment of the cost of the operating system and upon completion of the period under consideration, if it was not subject to revision after the modernization/reconstruction of the operating system (based on the Ministry of Finance of the Russian Federation dated July 2011).

If, upon completion of the modernization/reconstruction, the technical parameters of the facility have been modified to such an extent that they now fully comply with the new established OKOF code (in this year there is a need to analyze both old and new codes), the object must be considered as a newly created OS.

Classifier in accounting

Resolution No. 1, which approved the OS Classifier for tax accounting purposes in 2019, clearly states the fact that the Classification must be used in tax accounting.

Resolution No. 1, which approved the OS Classifier for tax accounting purposes in 2019, clearly states the fact that the Classification must be used in tax accounting.

The content of this resolution excludes the fact that the Classifier in question can be applied directly in accounting. In fact, this is natural. This is largely due to the fact that current legislation should not regulate issues regarding accounting. But can this really mean that the Tax Classifier cannot be used in accounting?

It is necessary to understand that the period of useful use in accounting is the time period during which an asset is required to fully bring economic benefit to the company (in other words, profit).

In strict accordance with PBU 6/01 regarding the accounting of fixed assets, which were adopted by the Order of the Ministry of Finance of the Russian Federation in March 2001, the useful life period can be calculated based on:

- the predicted period of use of a particular object in strict accordance with the expected productivity or power;

- predicted physical wear and tear, which directly depends on the operating period (number of shifts), as well as natural conditions and the level of environmental influence, taking into account the frequency of repair work;

- various regulatory and other restrictions on the use of a specific object (for example, the rental period).

Based on all of the above, we can conclude that in accounting the company has every right to calculate the useful life period on its own, without taking into account any established standards or classifiers.

It is necessary to take into account the fact that there is no prohibition on the use of the OS Classifier adopted for tax purposes in accounting.

Most companies use this Classification for accounting purposes, and have consolidated a similar procedure in their own. This method is chosen solely for the purpose of optimizing accounting work, as well as the possible convergence of accounting and tax accounting (including the possible goal of avoiding the obligation to use temporary differences).

Additional information is in this video.

All fixed assets, depending on their depreciation group, have a useful life (SPI). The 2017 classifier “useful life of fixed assets” allows you to determine the depreciation group of an object, as well as its SPI.

How to find out the depreciation group of an object and its SPI

To find out which depreciation group an object belongs to, you need to find its name in the classifier.

After the depreciation group has been determined, you can find out the SPI from the following table:

The organization has the right to independently choose the SPI of an object within its depreciation group.

If the object is not in the classifier, the useful life of fixed assets can be found from the manufacturer’s recommendations or technical documents.

How to determine the SPI of a previously used object

When purchasing an object that was already in use by another company, difficulties may arise in determining the SPI.

A company can establish an SPI in one of the following ways:

- The period is set according to the classifier, but it must be reduced by the period of operation by the previous owner;

- The period set by the previous owner must be reduced by the actual time of use.

New OKOF 2017

In 2017, a new OS classifier was introduced. It is designed according to international norms and standards. The previous version of OKOF has been in effect since 1994.

The changes affected the structure of OS codes. Previously, codes had nine characters, now they have twelve. Previously, codes had the following structure: Х.Х.ХХХХ. X. XX, now it’s like XXX. XX. XX. XX. XXX.

You need to use new codes only in relation to those OS objects that were put into use in 2017. For “old” objects, there is no need to recalculate SPI and depreciation.

Transition to the new OKOF

In order to facilitate the transition to the new OKOF, special transitional compliance keys were developed. These keys are tables with the names of subgroups and groups. When working with them you need to keep the following in mind:

- For forward transition tables, the old value is set to correspond to the new one (one or more). If the exact names of objects are not in the list, the most suitable name is taken.

- For reverse transition tables, the new value corresponds to the old one (one or more).

The procedure for the transition will be as follows:

- Check whether the OS code is written correctly in accordance with the old rules that were in force before January 1, 2017.

- Using transition keys, determine the new OS object code.

- Enter information about the new code into the object's inventory record card. At the same time, make a note that the new code has been in effect since 2017. There is no need to re-qualify the OS, you just need to enter their new code values. Only property related to industrial property needs to be reclassified.

- Establish a new depreciation group for fixed assets (this item applies only to those objects that were put into use after 2017). Old objects do not need to change their SPI period and depreciation group. If there is no suitable code for the OS, you need to take a higher level value.

Fixed assets (FPE) of an organization, depending on the useful life (USI) of this property for profit tax purposes, belong to one or another depreciation group of fixed assets (clause 1 of Article 258 of the Tax Code of the Russian Federation).You can download the 2017 classifier of fixed assets by depreciation groups at.

The organization itself determines the useful life of the OS, taking into account the special classification approved by the Government of the Russian Federation.

Classification of fixed assets included in depreciation groups

In 2017, the Classification approved by Decree of the Government of the Russian Federation No. 1 is in effect. In accordance with this Classification, all fixed assets are divided into 10 depreciation groups.

The 2017 classification of fixed assets by depreciation groups is as follows:

|

Depreciation group number |

Useful life of OS |

Example of fixed assets belonging to the depreciation group |

|---|---|---|

|

First group |

From 1 year to 2 years inclusive |

Mobile and special compressors |

|

Second group |

Over 2 years up to 3 years inclusive |

Artesian and submersible pumps |

|

Third group |

Over 3 years up to 5 years inclusive |

|

|

Fourth group |

Over 5 years up to 7 years inclusive |

Electric heaters |

|

Fifth group |

Over 7 years up to 10 years inclusive |

Facilities for livestock farming |

|

Sixth group |

Over 10 years up to 15 years inclusive |

Water intake well |

|

Seventh group |

Over 15 years up to 20 years inclusive |

Packaging machines |

|

Eighth group |

Over 20 years up to 25 years inclusive |

Cargo-passenger river vessels |

|

Ninth group |

Over 25 years up to 30 years inclusive |

Water treatment plant |

|

Tenth group |

Over 30 years |

Non-residential buildings (except for buildings included in other depreciation groups) |

How to determine depreciation group

To understand which depreciation group your fixed asset belongs to, you need to find it in the Classification. Having found it, you will see which group this OS belongs to.

If your OS is not named in the Classification, then you have the right to independently determine the useful life of this property, focusing on the service life specified in the technical documentation or the manufacturer’s recommendations. The established SPI will tell you which depreciation group your OS falls into.

Depreciation groups since 2017

From 01/01/2017, organizations will need to use the updated classifier of depreciation groups (changes were made by Decree of the Government of the Russian Federation No. 640).

The adjustment is due to the fact that from the beginning of 2017 the All-Russian Classification of Fixed Assets (OKOF) OK 013-2014 (SNA 2008) comes into force.

Accordingly, when putting fixed assets into operation in 2017, you need to be guided by the new Classifier. OSes put into operation before 01/01/2017 are not affected by this innovation. That is, such fixed assets remain in the same depreciation group as they were originally, even if, in accordance with the new Classifier, they should be assigned to a different group.

By the way, to make it easier for organizations to master this OKOF, Rosstandart published a comparative table of new and old codes (Rosstandart Order N 458).

Depreciation groups of fixed assets in 2017 are determined according to new rules. Let's look in detail at which classifier of fixed assets to use by depreciation groups from 2017.

How to use a classifier of fixed assets by depreciation groups in 2017

A new classification of fixed assets by depreciation groups will be in effect in 2017. Depreciation on fixed assets put into operation from 2017 will be determined in accordance with new codes and service lives. This is due to the fact that a new edition of the Classifier of Fixed Assets (OKOF OK 013-2014) has come into force.

According to the new edition of the classifier, starting from 2017, useful lives will be determined by new depreciation groups of fixed assets in accordance with new codes. The update of the directory was approved by Decree of the Government of the Russian Federation N 640.

To include the cost of a fixed asset in the cost of manufactured products, depreciation is charged on it during the useful life of this fixed asset. Depreciation deductions are nothing more than the deduction of part of the cost of fixed assets to compensate for their wear and tear. The depreciation period is determined by the depreciation group to which this fixed asset was assigned according to the all-Russian classifier of fixed assets, and if this object is not on the list, established by the organization independently.

Since the useful life affects the amount of monthly depreciation in tax accounting, it is important to determine it correctly. Let's look at this in detail.

Useful life of fixed assets: classifier in 2017

According to Article 258 of the Tax Code of the Russian Federation, the useful life is the period during which an object of fixed assets serves to fulfill the goals of the organization's activities. The same article of the Tax Code of the Russian Federation describes the basic rules for determining the useful life of fixed assets available in an organization.

How to determine the useful life of fixed assets in 2017 (classifier)

The organization must determine the useful life of fixed assets independently in 2017, using the Classification of fixed assets included in depreciation groups. This Classification is a table of three columns. The first column is the code of the fixed asset according to OKOF (all-Russian classifier of fixed assets), the second column contains the name of the fixed asset, the third column is needed for notes. All fixed assets indicated in the table are distributed by depreciation groups. Depreciation groups indicating possible useful lives are listed in Article 258 of the Tax Code of the Russian Federation.

If the fixed asset is not included in the classification, then the useful life of the fixed asset in 2017 is established based on the manufacturer’s recommendations and (or) technical specifications.

At what point should the useful life be determined?

The useful life of fixed assets is established by the organization at the time of commissioning of the fixed asset. In this case, the organization can increase the useful life after it has put the equipment into operation. This is allowed if its characteristics have changed as a result of reconstruction, modernization or technical re-equipment of the fixed asset

How is depreciation of fixed assets calculated in 2017?

Let's see how depreciation of fixed assets is calculated in 2017 using an example.

We purchased a personal computer, which, in accordance with PBU 6, we classify as fixed assets. According to OKOF (version before 01/01/2017), a personal computer has code 14 3020000 “Electronic computing equipment, including personal computers...”. This code belongs to the second depreciation group (property with a useful life of more than 2 years up to 3 years inclusive). Accordingly, we set the useful life of our fixed asset and depreciate it over a period ranging from 2 years 1 month to 3 years.

For the convenience of users, we have compiled an auxiliary cheat sheet of depreciation groups in 2017.

Depreciation groups of fixed assets in 2017:

No./item |

Depreciation group of fixed assets |

Useful life |

|---|---|---|

|

first group |

short-lived property with a useful life from 1 year to 2 years inclusive |

|

|

second group |

property with a useful life of more than 2 years up to 3 years inclusive |

|

|

third group |

property with a useful life of over 3 years up to 5 years inclusive |

|

|

fourth group |

property with a useful life of over 5 years up to 7 years inclusive |

|

|

fifth group |

property with a useful life of over 7 years up to 10 years inclusive |

|

|

sixth group |

property with a useful life of over 10 years up to 15 years inclusive |

|

|

seventh group |

property with a useful life of over 15 years up to 20 years inclusive |

|

|

eighth group |

property with a useful life of over 20 years up to 25 years inclusive |

|

|

ninth group |

property with a useful life of over 25 years up to 30 years inclusive |

|

|

tenth group |

property with a useful life of over 30 years inclusive |

Changes in depreciation groups in 2017

When determining the depreciation period, we are guided by the all-Russian classifier of fixed assets, which changed in 2017.

Changes in the directory will affect both the classification codes themselves and depreciation groups.

Example:

In 2015, the company purchased a metal fence, which, according to OKOF (version before 01/01/2017) had code 12 3697050 and belonged to the 8th depreciation group, the service life of which was set from 20 to 25 years inclusive, the company set a useful life of 25 years .

In 2017, the company again purchased a metal fence, but, according to OKOF (version dated January 1, 2017), the fence has code 220.25.11.23.133. Such objects belong to the 6th depreciation group, that is, the company will set a useful life in the range from 10 to 15 years inclusive.

New OKOF codes in 2017

New classification codes will also appear, as well as codes that generalize previously existing positions.

Example:

OKOF positions (until 01/01/2017) “15 3410211 Truck tractors with a saddle load of up to 3 tons”, “15 3410212 Truck tractors with a saddle load of up to 3 - 5.4 tons” is brought into compliance with OKOF (after 01/01/2017) position "310.39.10.05 Motor vehicles for special purposes."

The procedure for switching to a new classifier

When a fixed asset is put into operation after January 1, 2017, the depreciation group and useful life are established in accordance with the new directory. For fixed assets that were acquired before January 1, 2017, recalculation of depreciation rates is not required.

Example:

When purchasing a metal fence in 2017, its useful life is set at 10 to 15 years, while the useful life established for a similar fence in 2015 (20 to 25 years) cannot be changed.

Reporting discrepancies and depreciation in 2017

Tax authorities may request clarification if there are objects for which depreciation is charged, but they are not subject to property tax. Such objects are listed in paragraph 4 of Article 374 of the Tax Code of the Russian Federation. Here is a ready-made sample of explanations.

Depreciation group of fixed assets 2017

In the previous classifier, the OS encoding was nine-digit. She looked like: XX XXXXXXX. In the new classifier, the encoding became twelve-digit, acquiring the following format: XXX. XX. XX. XX. XXX. This innovation greatly changed the structure of OKOF.Some lines from the old OKOF were completely removed, and in the new one they were changed to general names. For example, instead of various unique types of software, an object called “information resources in electronic form” appeared.

Also, as changes, we can highlight the new location of some fixed assets relative to one or another depreciation group. This means that for some objects their SPI has changed.

Transition to a new classifier

The new classifier of depreciation groups of fixed assets will be applied only to those objects that were put into use after January 1, 2017. That is, it is not necessary to re-determine the depreciation group of fixed assets acquired in previous years, even if the SPI was changed in the new classification.

Special ones have been developed specifically for facilities that companies will put into use after January 1st. tools that allow you to switch to the new OKOF almost “painlessly” in 2017.

Determination of depreciation group in 2017

As noted above, a new OS classifier came into force in 2017. To find out the depreciation group, just look at it in the table.

It is worth noting that the procedure for calculating depreciation has not changed; it will be calculated on the same basis as in previous years.

If an accounting employee knows the old OS code, but needs to learn the new one, he can use a special transition table. It is in Rosstandart order No. 458.

How to determine the SPI of an object

Determining the SPI of an object occurs in several stages:

Stage 1. Establishing the depreciation group to which the object belongs.

For tax purposes, the Classification determines:

Depreciation group. There are ten groups in total, property is distributed among them depending on the private investment property.

SPI. It must be within the deadlines set for a particular group.

The depreciation group can be determined by OKOF. This is done as follows:

In the first column of the classifier, the type of property to which the object belongs is searched;

In the first column of the Classification, you need to check the code written in OKOF;

If the code is in the Classification, you can see which group the OS belongs to.

If the Classification does not contain the code of the required asset, the depreciation group can be determined in one of two ways:

1. By OS subclass code;

2. By OS object class code.

Stage 2. Definition of SPI. If there is no mention of an object in the OKOF, the SPI is determined based on the period of use of the object, which is indicated in the manufacturer’s recommendations and technical documents.

Stage 3. Fixing SPI in the object’s inventory record card. If accounting and tax accounting are maintained differently, then the corresponding column must be added to the second section of the inventory card.

Classifier of fixed assets by depreciation groups 2017

Since 2017, the new edition of OKOF OK 013-2014 (SNA 2008) comes into force. Because of this, it became necessary to create an updated classifier of fixed assets included in depreciation groups, which will use OKOF codes from the latest directory.Those. For fixed assets that will be put into operation from 2017, useful lives will be determined by depreciation groups in accordance with new codes.

By the way, to make it easier for companies to switch to the new OKOF, Rosstandart published a comparative table of new and old codes (Rosstandart Order N 458).

First group:

Cars and equipment.

Second group:

Cars and equipment;

Means of transport;

Perennial plantings.

Third group:

Cars and equipment;

Means of transport;

Fourth group:

Building;

Facilities and transmission devices;

Cars and equipment;

Means of transport;

Industrial and household equipment;

Working cattle;

Perennial plantings.

Fifth group:

Building;

Facilities and transmission devices;

Cars and equipment;

Means of transport;

Industrial and household equipment;

Sixth group:

Facilities and transmission devices;

Dwellings;

Cars and equipment;

Means of transport;

Industrial and household equipment;

Perennial plantings.

Seventh group:

Building;

Facilities and transmission devices;

Cars and equipment;

Means of transport;

Perennial plantings;

Fixed assets not included in other groups.

Eighth group:

Building;

Facilities and transmission devices;

Cars and equipment;

Vehicles;

Industrial and household equipment.

Ninth group:

Building;

Facilities and transmission devices;

Cars and equipment;

Vehicles.

Tenth group:

Building;

Facilities and transmission devices;

Dwellings;

Cars and equipment;

Vehicles;

Perennial plantings.

New shock absorption groups 2017

An item of fixed assets acquired by a company is reflected in tax accounting with the definition of a specific depreciation group. The period during which the cost of fixed assets will be taken into account in income tax expenses depends on it. When classifying a particular piece of property as a depreciation group, the company must be guided by the Classification of Fixed Assets, in accordance with Decree of the Government of the Russian Federation No. 1. And this document, in turn, is based on the All-Russian Classifier of Fixed Assets (OKOF), approved by Resolution of the State Standard of Russia No. 359. In this huge The document presented, perhaps, all possible types of objects that could only be important for maintaining company records at the time the document was put into effect. However, this classifier in its current form will very soon lose its relevance. New OKOF codes have been introduced since 2017.About the main changes in OKOF

In the current classifier, the coding of fixed assets had a 9-digit value of the form XX XXXXXXX. In the new OKOF, starting from 2017, it will be a digital designation of the format XXX.XX.XX.XX.XXX. This innovation quite significantly changed the very structure of the classifier.

Some positions of the old classifier were actually deleted, and in the new OKOF they were replaced with generalized names. For example, instead of unique types of various software registered in separate lines in OKOF (operating systems and means of their expansion, database management software, service programs, application programs for design, etc., in total more than a dozen software items), such an object will appear, as “Other information resources in electronic form.” At the same time, OKOF-2017 will contain many objects that had no analogues in the previous edition, including due to the virtual absence of such equipment in the 90s of the last century.

Among the changes in OKOF since 2017, one can also note the new location of individual fixed assets relative to one or another depreciation group. In fact, this means the introduction of different useful life periods for individual fixed assets, and therefore a change in the period during which the initial cost of such property has traditionally been written off in tax accounting until now.

Transition to new OKOF from 2017

At the same time, it should be noted that the new OKOF directory from 2017 will apply only to those fixed assets that the company will put into operation from January 1 of the next year. Simply put, there is no need to re-determine the depreciation group of an asset purchased earlier, even if, according to OKOF-2017 with decoding and group, the useful life of such an object would have to change.

Depreciation on “old” fixed assets will need to be taken into account in the same manner, that is, without changing the initially determined period for writing off expenses.

For the property that companies will work with after the new year, special tools have been developed that will allow a relatively painless transition to the new OKOF starting in 2017. These are the so-called direct and reverse transition keys between the edition of the All-Russian Classifier of Fixed Assets, sample 1994, and OKOF-2017. And you get depreciation groups with decoding from this document for both editions at once.

They are presented in Rosstandart Order No. 458. The document suggests comparison table, which compares specific fund objects. Using this table, you can relatively easily select a new encoding for a particular object. By the way, if the OKOF code was still registered in the fixed asset accounting card, then it should be updated. However, in the OS-6 standard form, indicating such a code was not mandatory. Accordingly, if the company did not use the coding from OKOF when drawing up the inventory card, then it will not need to add a new code to it.

Many accountants are already wondering about service life of fixed assets since 2017. Why suddenly? The point is that big changes are coming. Therefore, we will tell you about them and how to adapt to new conditions.

Who will be affected?

Almost any self-respecting company has a couple of fixed assets (hereinafter also referred to as fixed assets) on its balance sheet. Therefore new standard service life of fixed assets will affect any business.

Moreover, this will also affect businessmen. So, on the one hand, they do not have to keep accounting records. On the other hand, they are required to establish the residual value of the fixed assets. After all, this gives the right to remain on the “simplified” system.

New

To begin with, in order to take into account the property, they find out the period of its useful operation. It is important for both types of accounting – tax and accounting. The main assistant accountant when determining this period:

- codes from the All-Russian Classifier of Fixed Assets (OKOF);

- government Classification of fixed assets for the purposes of assignment to depreciation groups (hereinafter referred to as the Classification).

Please note: the changes affected both of these documents. Thus, since 2017, the Classification has undergone adjustments. They were introduced by Decree of the Government of the Russian Federation dated July 7, 2016 No. 640. In addition, new OKOF codes will come into effect starting next year: OK 013-94 will be replaced by OK 013-2014.

It must be said that all these regulatory documents are insanely long multi-page tables with types of OS, codes and deadlines. Therefore, you can easily get confused and also waste a lot of time.

But I didn’t forget about Rostandart accountants. He issued order No. 458 dated April 21, 2016, which helps to understand which old OS code corresponds to the new one. And vice versa. Also in the form of tables.

Since 2016, property must cost more than 100,000 rubles in order to consider it fixed assets and depreciate it.

Let's find out how updating the codes will affect the work of an accountant.

How to determine

In 2016, you need to continue to find out the code of a specific fixed asset by classifier of service life of fixed assets OK 013-94. And the depreciation group of the registered property is according to the government Classification dated January 1, 2002 No. 1.

Let us remind you that the law does not oblige you to use these forms in your work. Therefore, if your company prefers its own developments, do not forget to add a window for OKOF code.

Keep in mind: The standard service life of fixed assets is the same for accounting and tax accounting.

A special reminder to simplifiers

New limit

In 2016, you can work on the simplified tax system, provided that the residual value of the fixed assets (it is needed for accounting purposes) is no more than 100 million rubles. (Subclause 16, Clause 3, Article 346.12 of the Tax Code of the Russian Federation). Let us immediately draw your attention to the fact that since 2017, this bar has been raised to 150 million. That is, more firms and individual entrepreneurs will be able to apply the simplified tax system.

Thus, for simplifiers, not only will it change service life of fixed assets since 2017.

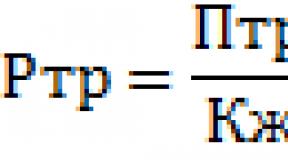

The residual value is determined using a simple formula:

First price – depreciation = residual value And in order to depreciate property (if this can be done by law), you need to clarify the service life (clauses 18 and 19 of PBU 6/01 “Accounting for fixed assets”). In fact, the organization determines it itself. True, we still advise you to look into the Classification for depreciation purposes. It was adopted by Decree of the Government of the Russian Federation dated January 1, 2002 No. 1. This will protect you from disputes with tax authorities.

Revision of the tax base

The use of the “income minus expenses” object in many cases allows tax accounting to include acquired fixed assets as expenses within one year. You just need to pay for the property and start working with it.

But keep in mind: if you quickly get rid of the decommissioned OS, tax base according to the simplified tax system for past periods will have to be revised. And the recalculation mechanism is influenced precisely by the service life of fixed assets (see table).